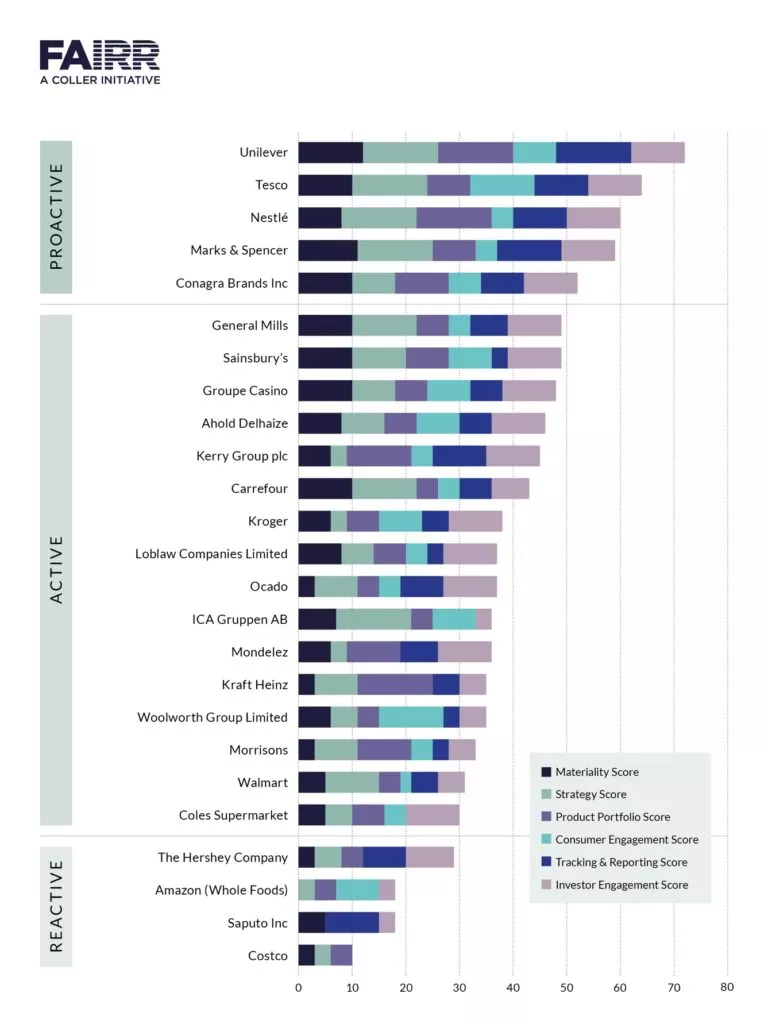

Unilever, Tesco, Nestlé, Marks & Spencer and ConAgra are the firms that have developed the most proactive strategy to develop a sustainable alternative protein portfolio, a new study has found.

The study, by FAIRR, a global network of investors addressing environmental, social and governance issues in protein supply chains, found that of a total of 25 firms studied, these five firms recognise more than others that a high dependence on animal-based ingredients could lead to business challenges in the future.

The five companies have also undertaken risk assessments on their protein supply chains and expanded their range of plant-based products over the previous year, FAIRR said.

Appetite For Disruption

FAIRR's report, Appetite for Disruption, finds that plant-based substitutes for traditional animal-based foods could capture 10% of the meat market within 15 years, and is currently valued at $19.5 billion.

It found that 87% of retailers have ramped up their own-brand plant-based products, and pledged to source more low-carbon protein sources in the future.

“From the factory floor to the supermarket shelf, the mounting environmental and social pressures to move away from a reliance on animal-derived proteins is reshaping the food industry," commented Jeremy Coller, Founder of FAIRR and chief investment officer at Coller Capital.

"The growth of alternative proteins, from meatless meats to fishless fillets, offers a promising opportunity for food companies to meet the lucrative demand for protein with fewer impacts on land, water and biodiversity," he added.

Active Search

The study found that 16 of the 25 companies were 'active' in terms of embracing alternative proteins, while four (Amazon, Hershey, Costco and Saputo) were ranked as 'reactive'.

Close to two thirds (64%) of the firms studied included terms like 'plant-based' and 'vegan' in their annual reporting and/or quarterly earnings calls in 2018/2019.

Almost all (23 out of 25) companies featured have expanded or announced plans to expand their alternative protein product portfolios in the last 12 months.

“For too long big food has been playing catch up to consumers and start-ups on alternative proteins, when they should be leading this transformation," said Coller.

"This report shows that some food multinationals are seizing the moment by setting clear strategic goals to increase their alternative protein exposure, supported by relevant metrics that are tracked and reported," he added. "That’s a good start, but as alternative proteins go mainstream, investors want more food retailers and manufacturers to capitalise on the opportunity including improving branding, merchandising and tracking of alternative protein products to expand their appeal across a broad swathe of consumers.”

© 2019 European Supermarket Magazine – your source for the latest retail news. Article by Stephen Wynne-Jones. Click subscribe to sign up to ESM: The European Supermarket Magazine.