The return of workers to offices and the start of the new school term are impacting how consumers shop in the UK, with signs of a return to 'top-up shopping', new data from Kantar has shown.

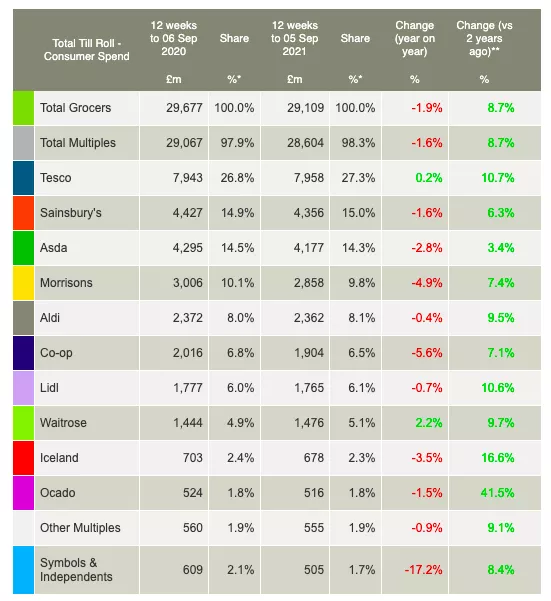

The latest take-home figures for the 12-week period to 5 September indicate that sales fell by 1.9% year-on-year, compared to the same period last year, an indication that shoppers are starting to embrace traditional shopping habits, and are seeking greater convenience.

“We are already tracking signs of fatigue when it comes to home cooking," commented Fraser McKevitt, head of retail and consumer insight at Kantar. "Sales of chilled ready meals, for example, increased by 11% this month as consumers’ lives get busier again.

"More people returning to towns and cities should also provide a boost for cafés and coffee shops, where spending last September was £187 million (€219.3 million) lower than in 2019."

Online Shopping Slows

Online shopping is also showing signs of retrenchment – the average online shop is now valued at £78.28 (€91.82), nearly £17 less than its peak at the start of the pandemic, Kantar said. In addition, the market share of online grocery has fallen to 12.2% this month, from 13% four weeks ago.

However, overall grocery sales remain 8.7% higher than pre-COVID levels, indicating that the impact of the pandemic is still being felt in the market.

In terms of the performance of the UK's biggest grocers, only Tesco (+0.2%) and Waitrose (+2.2%)| have seen sales up year-on-year in this period, however most grocers are still seeing sales well ahead of where they were in the corresponding period in 2019 – in Ocado's case, 41.5% higher.

Big Four Performance

In terms of the UK's Big Four, Tesco still commands a healthy lead (27.3% market share), over Sainsbury's (15.0%), Asda (14.3%) and Morrisons (9.8%), however recent investments are likely to have an influence on how these grocers position themselves going forward.

“Private equity interest in Morrisons has been driven in part because it was the fastest growing of the four major retailers in 2020," said McKevitt. "But it has fallen back this year because of a tough comparison with the success of 12 months ago.

"Asda, meanwhile, is looking at its role in the convenience market and recently announced its intention to launch its new ‘On the Move’ garage forecourt stores. There is huge opportunity in that sector to tap into the 3.7 billion take-home grocery trips of less than £20 made every year."

Grocery inflation stood at 0.1% for the 12-week period ending 5 September, with prices are rising fastest in markets such as savoury snacks, cat food, ambient cakes and pastries, Kantar said.

© 2021 European Supermarket Magazine. Article by Stephen Wynne-Jones. For more Retail news, click here. Click subscribe to sign up to ESM: European Supermarket Magazine.