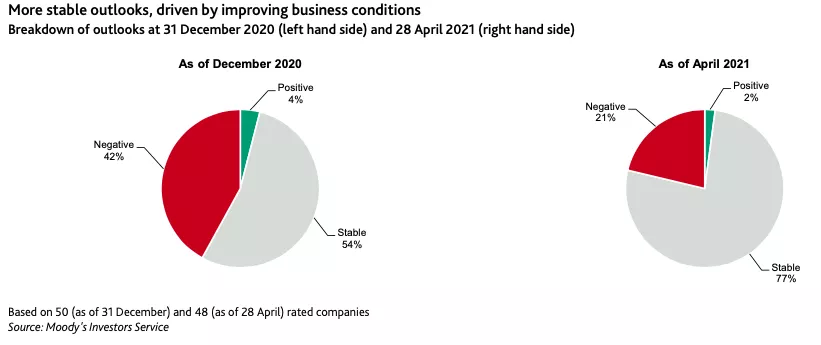

Moody's has updated its outlook on the European retail industry to 'positive' from 'stable', as operating conditions for retailers affected by the pandemic starts to improve as a result of the vaccine rollout and easing of COVID-19 restrictions.

In food retail, Moody's said that demand will ease compared to prior lockdown highs, but a reduction in associated costs will support profitability in the sector.

Moody's is expecting adjusted EBITDA for the retailers it rates to rise by around 10% this year, compared to 2020, it said in a report, Outlook moves to positive as operating conditions improve.

Pent-Up Demand

'When lockdown restrictions are lifted, the release of pent up demand will help drive sales across a range of discretionary segments including apparel, health and beauty and eventually also travel-related retail,' Moody's said.

However, at least two in five retail firms are likely to post lower EBTIDA this year compared to 2019, with this contrast most pronounced among clothing and apparel retailers that are reliant on bricks and mortar estates.

While year-on-year EBITDA growth of around 28% is expected for this cohort of retailers, profit for more than half of them will be more than 20% lower than in 2019.

As Moody's notes, the coronavirus pandemic has accelerated the shift online, and while this is likely to lessen as restrictions ease, e-commerce is here to stay.

'More consumers will continue to shop online after all social distancing restrictions end, but probably less often than they did during the pandemic,' it said. 'This change will benefit companies able to exploit opportunities to grow in this channel. However, overall it is margin dilutive for the sector because store sales densities decline and home delivery costs are high for companies which lack true scale online.'

Margin Improvement

Strong competition, particularly in the grocery sector, means that meaningful margin improvement is unlikely, with Moody's citing the UK grocery market as a prime example, with incumbents such as Tesco, Sainsbury's, Asda and Morrisons 'returning to fight old battles' with discounters Aldi and Lidl.

For fashion retailers, meanwhile, the need to adapt to growing environmental and social scrutiny is a challenge which will have renewed focus after the pandemic, Moody's said.

© 2021 European Supermarket Magazine. Article by Stephen Wynne-Jones. For more Retail news, click here. Click subscribe to sign up to ESM: European Supermarket Magazine.