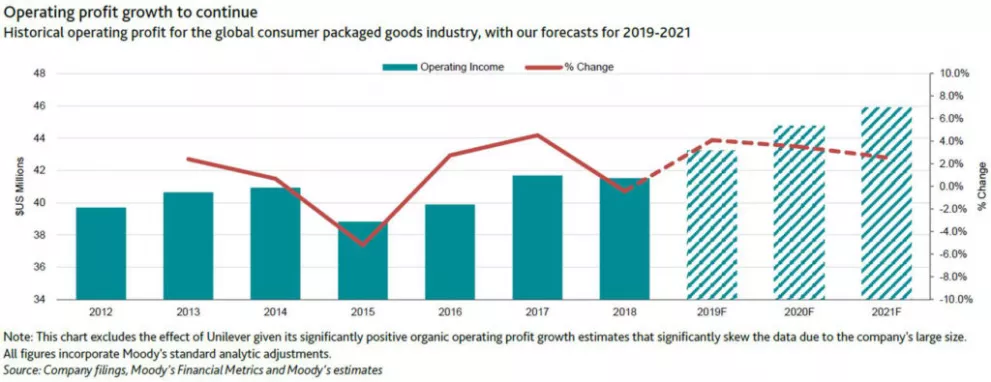

The consumer packaged goods (CPG) industry is set to post aggregated operating profit growth of between 3% and 3.5% over the next 12 to 18 months, according to a new report by Moody's.

The report, Outlook remains stable on moderating commodity costs, growth in prestige beauty, has found that firms with 'sizeable exposure' to developing markets are likely to benefit most, due to a growing middle class in these markets.

Emerging Market Benefits

Companies expected to benefit from phenomenon this include Procter & Gamble, Estee Lauder, L'Oreal and Unilever, Moody's said.

'We expect G-20 emerging market economies to continue to grow at a faster pace than G-20 advanced economies,' it said.

Some relief in commodity pricing is also likely to enhance profitability, as is a reduction in transportation costs, Moody's added.

'At the same time, some companies successfully increased prices to offset high input costs and costs from new product introductions,' it said. 'These price increases will continue as an earnings tailwind in the year ahead.'

Elsewhere, 'sustained demand' in the travel retail market is likely to boost profit growth for prestige beauty firms, such as Estee Lauder, L'Oreal and Shiseido, where 'gains will partially offset the decline in US department store foot traffic'.

Acquisition Hunt

Acquisition spend is likely to rise in the CPG sector in the coming years, as firms seek to boost margins, expand their product ranges, and enhance geographic diversity, with most transactions likely to 'improve cash flow'.

Cost-cutting initiatives, too, will remain a key driver of profit growth in the sector, with restricting at firms such as P&G, Estee Lauder and Kimberly-Clark already reaping benefits.

Better Than Expected?

While it has maintained a 'stable' outlook for the sector, Moody's also suggested that there are factors that could change its forecast, with an upgrade likely if certain circumstances emerge.

'We would consider changing the outlook to positive if we expect operating profit growth to exceed 4% in the coming 12-18 months,' it said.

'Likely drivers would include new innovations to spur growth in what are largely mature categories. We would consider shifting to a negative outlook if we expect sharp declines in volume and pricing, or significant global economic slowdown, all of which we believe are unlikely.'

Rising interest rates in the sector could also have a bearing, Moody's added. The outlook for the sector has been 'stable' since March of this year.

© 2019 European Supermarket Magazine – your source for the latest retail news. Article by Stephen Wynne-Jones. Click subscribe to sign up to ESM: The European Supermarket Magazine.