The European corrugated packaging industry is seeing rapid M&A growth and shaping the Continent’s landscape. ESM speaks to Susan Hansen and Natasha Valeeva of Rabobank about the dynamics therein. This article previously appeared in Issue 6 – 2017 of ESM: European Supermarket Magazine.

Merger activity in the European corrugated packaging industry is at all-time peak levels and is only likely to rise further, according to a recent paper by Rabobank, The European corrugated packaging industry – moving towards the US market structure?, which forecasts an increasingly consolidated packaging landscape on this side of the Atlantic.

According to the bank, slim margins within the sector, coupled with firms’ need for a wider geographical presence, are likely to bolster acquisition activity, similar to US market trends over the past 20 years.

However, while US consolidation took place at a relatively fast pace, the fragmented, multinational, often family-led nature of the European market means that M&A activity may take place at a more controlled, targeted pace.

“The US is one country, bound to one set of regulations, whereas Europe has so many different countries with different regulations, different ways of doing business, and different cost structures,” says Natasha Valeeva, analyst – F&A supply chains, at Rabobank.

“It’s like when you think of a pizza in the US, compared to in Italy. In the States, a pizza is a pizza, and you have a few chains all doing the same thing. In Italy, whichever region or city you go to, the pizza is different. It might taste similar, but it has a whole set of unique, local characteristics.”

State Of The Nation

As a result of the rise of online grocery, innovation and the substitution of other packaging materials, the corrugated packaging market has shown strong growth in Europe over the past decade.

Between 2006 and 2016, Rabobank’s report reveals, containerboard capacity increased by 17%, from 31.7 million tonnes to 38.4 million tonnes, in Europe overall. There are currently 251 active containerboard mills in Europe, with strong capacity expansion over the past number of years, in Germany, Russia, Turkey and Poland. Together, the leading production countries (Germany, Russia, France, Spain and Turkey) account for 58% of total containerboard capacity and 51% of the mills between them.

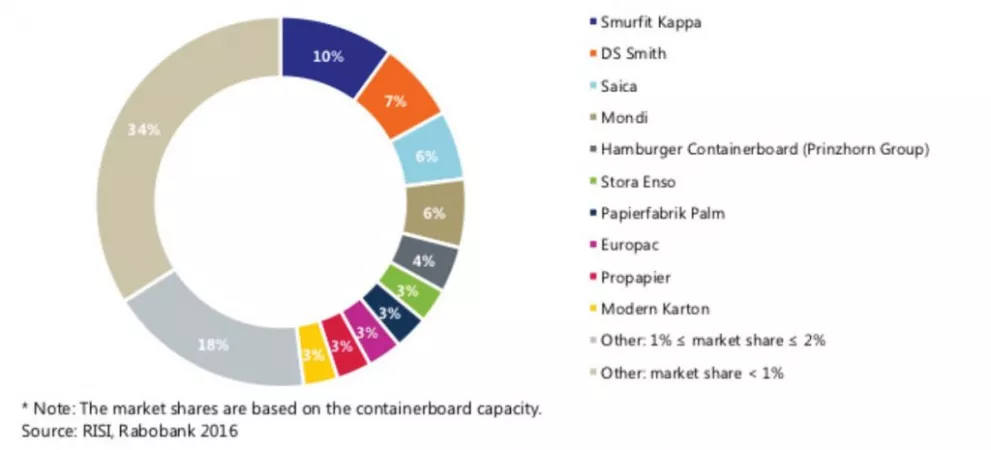

European containerboard market shares (based on capacity), 2016*

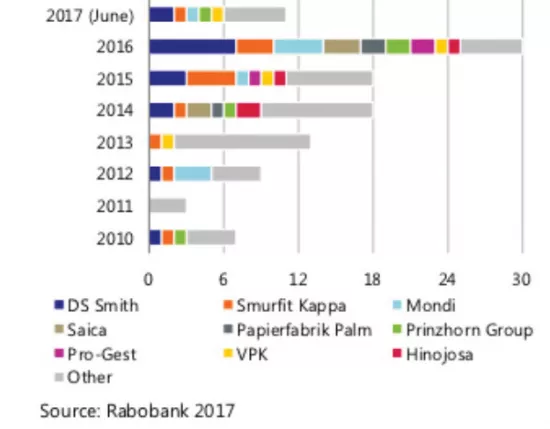

Within these markets, the number of mergers and acquisitions among corrugated packaging businesses has accelerated, particularly in the past four years, as businesses chase greater geographical reach and economies of scale. There have been 109 notable M&A deals since 2010, and last year, 2016, saw a record 30 deals take place (between January and June of this year, 11 deals were completed). An analysis of the businesses involved in said transactions indicates the sort of strategic acquisitions taking place within this buoyant market.

M&A deals in the European container board and corrugated packaging industry by main player (2010 to June 2017)

Leading The Way

Among the publicly listed large-scale packaging businesses in Europe, Smurfit Kappa, DS Smith and Mondi have been at the forefront of M&A activity. At Smurfit Kappa, the focus has been on overseas expansion, with major deals in North America and Latin America in the past year or so.

DS Smith, meanwhile, has focused on strategic bolt-on acquisitions to its business, in order to facilitate a value-added proposition (including point-of-sale operators and bag-in-box technology), while also making a play in the US. For Mondi, the focus has been on growing its conversion capabilities, with acquisitions in Russia and Poland, helping the business become more vertically integrated.

Aside from this, the likes of Saica, Prinzhorn Holding and Papierfabrik Palm have sought to grow their conversion capabilities, with Saica (and Mondi) also active in terms of diversification into the flexible packaging segment.

“It’s a case of supply and demand,” says Susan Hansen, global strategist – F&A supply chains, Rabobank.

“Sometimes M&A activity slows down because the valuation of small companies gets too high – would-be acquiring companies adopt a wait-and-see approach – but the number of potential targets out there is still significant, meaning: we are unlikely to see much of a slowdown in the coming years,” Hansen continues.

Consolidation Continues

There are numerous factors pointing towards a continuation of the consolidation process in the European corrugated packaging industry. Pressure on margins means that leading players need to operate more efficiently and gain economies of scale. Entry into certain markets (such as Latin America) can also ensure a low-cost pulp supply.

Localisation is also a factor, with Rabobank estimating that it is economically viable for corrugated packaging to transport no further than 400 kilometres from the corrugator, and preferably within 200 kilometres thereof. Similarly, in the conversion industry, production needs to be closer still to the end market, in order to ensure efficiency.

“You can transport containerboard long distances,” says Hansen, “but when you look at the conversion process, which produces packaging for suppliers and for retailers, this really needs to be close to the customer. This is part of the reason why we haven’t seen a huge rise in investment in conversion in Eastern Europe, for example. For packaging in general, you need to be close to where the food and the beverages are produced and need to be packed, and most of the time, this is in Western and Northern Europe.”

Another factor is the family-owned nature of the European packaging business. The corrugated packaging sector comprises many private, family-owned businesses, many of which have no succession plans in place, leading to interest from said businesses in possible mergers (of course, this can also work the other way, with many proudly family-run businesses staunchly opposed to selling the family jewels).

“Succession can be a driver of the consolidation because of the market structure, but there are often two sides to the story: many families are not that willing to sell,” says Valeeva.

Recycling Matters

Where Europe has an advantage, from a cost-saving point of view, is the rate of recycling that takes place in the containerboard sector, which, as things stand, is well ahead of that in the US.

Says Hansen, “In Europe, the raw-materials supply of containerboards is largely comprised of recycled materials – as high as 80%. These figures are largely the same in many other markets, except the US, where just 30% of the containerboard is made from recycled materials.

“Some 20 to 30 years ago, Europe really made a big jump in terms of recycling and developed a collection process that is also very effective. Added to that, of course, consumer pressure is much tougher than in the US. All stakeholders and big companies are looking more towards sustainability, and they then push this back to the producers.

“Actually, it’s important to recognise that the packaging producers themselves really would like to use more recycled material because, in general, they are cutting costs, which means the European sector is well positioned for growth.”

Room To Move

At present, the top five producers in the containerboard market account for just 33% of the market share, while the top ten account for less than half (48%), meaning that there is plenty of room for further M&A activity. Only three players – Smurfit Kappa, DS Smith and Mondi – have what could be considered pan-European containerboard mill coverage, with operations in nine, seven and five countries, respectively.

Within the corrugated conversion segment, there is even more fragmentation, with as many as 1,000 conversion operations across Europe – some small-scale, family-run businesses, others boasting multinational operations. With increased momentum towards vertical integration within the sector, interest in conversion from the major corrugated players is likely to grow in the coming years.

Indeed, vertical integration is one of the factors that has bolstered the US corrugated packaging sector, which has seen rapid consolidation in the past two decades. In the US, the main containerboard producers have as much as 90% integration within their businesses, while in Europe, this stands at around 50%.

This has led to greater EBITDA margins: 16.2% on average between 2014 and 2016, compared to 12.9% in Europe. No wonder, therefore, that large European producers are so keen to enter the US market.

At the same time, of course, many small to medium-sized operators are reticent to embrace full integration.

“For some companies, integration makes perfect sense because they need the economies of scale and want to cut costs,” says Hansen, “but for others, there is an opposition to integration because they feel they are more flexible if they are less integrated. There are many different operating models within the sector.

“For example, there was a lot of pricing pressure in the past year in the raw-materials market, which means that if you operate a business with low margins, you are really going to feel the impact.”

© 2018 European Supermarket Magazine – your source for the latest retail news. Article by Stephen Wynne-Jones. Click subscribe to sign up to ESM: The European Supermarket Magazine.