Ocado has confirmed plans to create a 50/50 joint venture with Marks & Spencer, in a move that one analyst has described as "materially better than we thought yesterday".

Under the terms of the agreement, Marks & Spencer will pay Ocado £750 million (€877 million), including deferred consideration, for a 50% share in a new joint venture being established by the online retailer.

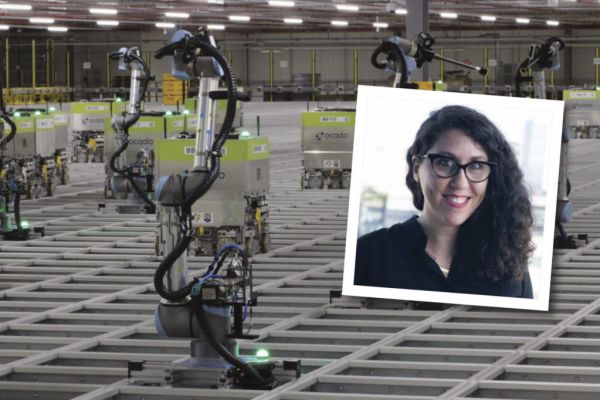

The joint venture combines Ocado's retail business, a new partnership for solutions services underlined by Ocado's Smart Platform, and the provision of branding and sourcing from M&S.

The joint venture will see M&S's food and beverage range combined with that of Ocado's on the online platform, for a total of 50,000 SKUs, with M&S products available from September 2020, upon the conclusion of the online retailer's current sourcing agreement with Waitrose.

In the process, the joint venture will become one of Ocado Solutions' largest partners, with the business agreeing to develop a number of customer fulfilment centres for Marks & Spencer over an indeterminate period.

"I have always believed that M&S Food could and should be online," said Steve Rowe, Marks & Spencer's chief executive. "Combining the strength of our food offer with leading online and delivery capability is a compelling proposition to drive long-term growth."

Here's how leading retail analysts viewed the coming-together of the two groups.

Bruno Monteyne, Bernstein Research

"Ocado confirmed this morning they are creating a 50/50 joint venture with M&S. The deal is materially better than we thought yesterday – we estimate worth £2.5 billion [€2.92 billion] plus. As per today's announcement, the retail business will become (a) new retail business valued at £1.5 billion [€1.75 billion], and (b) a new solutions contract between that retail business and the new M&S solutions business.

"Ocado wins thrice: (a) by monetising its retail business, (b) by signing up a massive new technology partner in M&S, and (c) preparing to become a real technology business. The cash from this deal will be used to fully fund the development of all CFCs currently committed with OSP."

Clive Black, Shore Capital

"For M&S, after considerable and sustained feasibility work into the online grocery channel, which, the group states, has been 'uneconomic due to the high cost of manually picking from store', amongst other things, the joint venture provides a mechanism to finally access the remote channel through a profitable mechanism that has scalable potential.

"The venture combines M&S's highly regarded and innovative food brand with Ocado's equally innovative smart platform technology, and whilst the financial outcome of the transaction is yet to be determined, M&S states that it sees 'long-term value creation opportunities for both M&S and for the joint venture'."

Catherine Shuttleworth, Savvy

"For Tim Steiner and his team, a deal could let them crack on with selling their tech solutions to retailers across the globe without being held back and distracted by the day-to-day of the Ocado UK retail trading business. With a new, shiny, exciting partner with a stated intention of growing through digital, they can cut the ties with Waitrose, a partner that they have never really fallen in love with. Their differences of opinion have been many and public over the last seven years.

"So, will it be enough to create a lever of growth for M&S? Well, that remains to be seen, but doing nothing isn’t an option. Amazon are on the prowl, and they have to strike soon, or could miss their moment in UK grocery. Amazon Prime is fast becoming a meal-for-tonight delivery service, but they still haven’t cracked a fresh-grocery delivery supply chain that UK consumers can trust.

"Of course, Morrisons are right in the middle of all of this, both with their supply deal with Amazon and their tech solution deal with Ocado, delivered by Morrison.com – possibly not the spot they’d choose. And Waitrose? Well, they might put a brave face on things, but this will be a blow. Already losing sales to the discounters, the thought of M&S now sweet-talking Waitrose shoppers is going to be a bitter pill to swallow."

Barclays European Food Retail Equity Research

"We can certainly see how it might be attractive for Ocado to focus primarily on its solutions business, rather than be seen as a hybrid retailer/technology company. This might have ‘intangible’ benefits for its valuation, and might have tangible benefits if Ocado can actually delegate many of the retail decisions to a focused retailer. A cash injection of £750 million [€877 million], even if 25% is deferred, would also have the clear benefit of significantly reducing the risk of any further capital-raising for Ocado for some time to come.

"For Ocado, having a joint-venture partner means that its interests will be very well aligned with that of M&S. This is perhaps a contrast to its relationship with Waitrose – this had been a mutually beneficial relationship overall, but, given the lack of security on both sides, was always subject to unhelpful uncertainty.

"This arrangement will clearly give M&S a presence in the growing online segment, albeit not immediately. M&S has lacked this to date, and it was not easy to envisage how M&S could make the online transition alone. Exposure to the faster growth being generated by the online channel is therefore the obvious plus for M&S.

"Raising £600 million [€701 million] of equity means that M&S is covering all of the upfront cash required. Given the additional EBITDA that should result from the transaction, this should mean that M&S modestly deleverages as a result."

Martin Lane, Money.co.uk

“Loyal M&S customers will be elated with the news the retailer is finally stepping into the digital age by joining forces with Ocado. This could be the boost that M&S need to lift their food business into the modern era, rather than being a top-up shop on the way home.

“The high street is still suffering, so it’s easy to see why M&S are exploring new avenues. It will be interesting to see whether there will be enough take-up of their products over Waitrose and Ocado’s own brands when using the delivery service. Ocado have proved their delivery service can work, and now everyone wants a piece of the luxury pie.”

David Beadle, Moody's

"In our view, the joint venture enables Ocado to deal with the looming maturity of the current Waitrose contract in a way that not just secures a fresh, long-term supply agreement, but also enhances profitability. This is because M&S has committed to supply products to the joint venture at cost, in contrast to the branding and sourcing fees currently payable to Waitrose.

"While this arrangement will, in isolation, be margin dilutive for M&S, higher total volumes arising from the deal should enable it to benefit from enhanced bargaining power with its suppliers. M&S in-store food sales should also receive a boost from Ocado.com customers visiting to replenish M&S products initially bought online."

© 2019 European Supermarket Magazine – your source for the latest retail news. Article by Stephen Wynne-Jones. Click subscribe to sign up to ESM: European Supermarket Magazine.