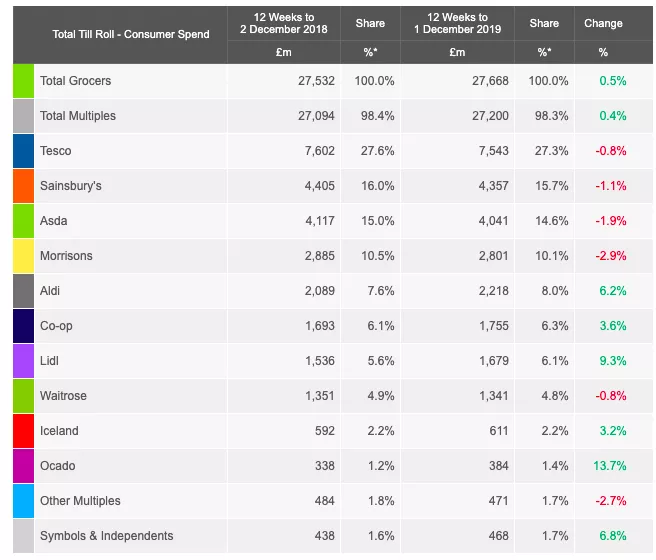

The UK's 'Big Four' supermarkets all saw a dip in sales in the 12 weeks to 1 December, according to the latest market share data from Kantar, with the discounters continuing to gain pace.

Market leader Tesco, which holds 27.3% market share, saw a 0.8% decline in sales, while Sainsbury's (15.7% share) was down 1.1% and Asda (14.6% share) was down 1.9%.

Morrisons saw the biggest slide of the Big Four retailers, with a 2.9% dip in sales. It holds 10.1% market share.

Familiar Favourites

However, all is far from lost, as Fraser McKevitt, head of retail and consumer insight at Kantar, explained, “While the big four all lost share in the past 12 weeks, 98% of the British public still visited at least one of their stores during the past three months.

"Based on previous years, we expect them to increase their proportion of sales in the coming weeks as shoppers turn to familiar favourites and the traditional retailers in December.”

Discounter Growth

At the same time, both discounters put in a solid performance ahead of the busy Christmas period.

Aldi saw its sales rise by 6.2% to now hold 8.0% share of the market, while Lidl posted a 9.3% increase in sales to sit on 6.1% share of the market.

“The good news continues for Lidl and 11.9 million shoppers visited one of its stores in the past three months – that’s 652,000 more than this time last year," said McKevitt.

"Lidl has been encouraging its customers to make bigger shops, running newspaper voucher deals that offer £10 off when the holder spends £40, and larger baskets over the qualifying spend made up 17% of trips in November.”

Other positive performances were put in by the Co-operative (6.3% share), which saw sales up 3.6%; Iceland (2.2% share), which saw sales up 3.2%; and Ocado (1.4% share), which saw a 13.7% increase in sales.

Overall, year-on-year supermarket sales growth slowed to 0.5% in the period, amidst the uncertainty of a General Election, a lacklustre Black Friday and a wet autumn, Kantar said.

Grocery inflation stood at 0.8% for the 12-week period.

© 2019 European Supermarket Magazine – your source for the latest retail news. Article by Stephen Wynne-Jones. Click subscribe to sign up to ESM: The European Supermarket Magazine.