The Irish retail sector still faces a "degree of vulnerability" and the Irish government needs to use this autumn's Budget announcement to put in place measures to bolster the sector, a leading representative group has found.

Retail Excellence, a not for profit group that represents around 1,700 retailers across Ireland, was commenting on the back of the publication of the Grant Thornton Retail Excellence Q4 2017 Retail Productivity Review earlier this week, which highlights the 'inconsistency of the performance of the industry', the group said.

“From trends recorded in the Irish Retail Industry it is clear that a degree of vulnerability continues to exist," commented Deputy CEO at Retail Excellence, Lorraine Higgins.

"While figures might be up marginally this has occurred at the expense of intensive marketing campaigns undertaken by retailers and consequentially reduced margins”.

The data shows that the fourth quarter of the year was a "challenging" one, Higgins noted, which is "undoubtedly attributable to a combination of factors [including] a dip in consumer sentiment which usually accompanies Budget announcements, and spending being postponed until Black Friday”.

Retail Data

On the face of it, the Retail Productivity Review indicates that the Irish retail sector is performing admirably. The study found that overall Irish retail sales were up 1.01% for the quarter, with an October dip of 1.86% followed by a November increase of 3.54%, and a December increase of 2.57%.

But Higgins said that despite the industry growing overall, retailers should take nothing for granted.

“Overall, the Irish retail industry recovery is marginal,"she said. "No longer can it be expected in budgets that increasing consumer spend will take care of retail. The industry continues to be threatened by the influx of cheap imports coming from non-EU websites and the failure to intercept every parcel coming in to Ireland from outside the EU and the consequential application of customs and VAT on such goods is a missed opportunity for the Exchequer.

"Retail focused policies and legislation must be implemented to curtail this. Budget 2019 provides an opportunity."

Grocery Performance

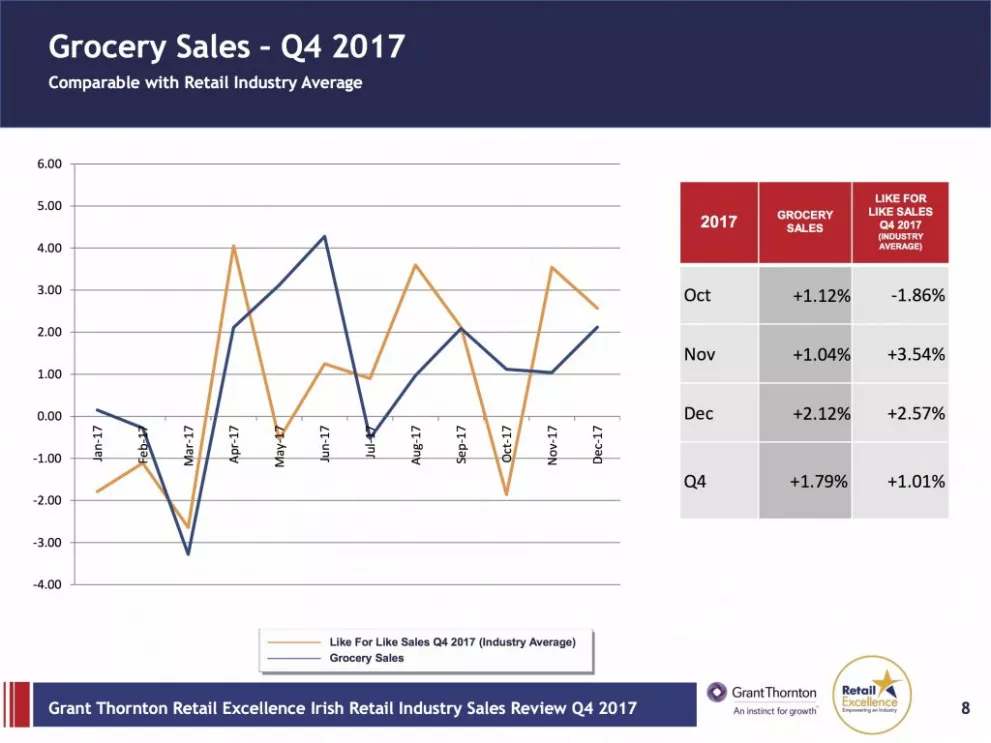

The Retail Productivity Review found that the Grocery sector outperformed the wider industry, posting 1.79% growth in the fourth quarter, and with all three months showing sales growth.

In October, the grocery market posted a 1.12% increase in sales, which was followed by a 1.04% increase in November (behind the overall market, largely as a result of Black Friday), while December was 2.12% higher.

Hot Beverages, another sector closely aligned with grocery, posted 2.01% sales growth for the period (again ahead of the industry average), with October seeing a 1.78% increase, November 2.24% higher and December 2.89% higher.

Other markets did not perform as strongly, however, with Jewellery down 4.58% for the quarter, Lingerie down 4.96%, and Ladies Fashion down 4.45%.

Factors affecting the wider retail sector include the propensity for Irish shoppers to buy online, with Damian Gleeson, partner, Grant Thornton, saying that "consumers are turning to online shopping outside of Ireland with convenience and perceived value being the primary contributing factors. This category of retailer is now operating in a global market.

"Online shopping is a game changer and I would expect further erosion in the area as new opportunities to shop online arise”.

Government Action

Retail Excellence believes that there is more that the government can do to deliver a more level playing field for traditional retailers, with one proposed measure being the introduction of VAT measures on online retailers.

"First and foremost we need to look at the online market places, and the fact that they don't have any duty on them," Higgins was quoted as saying by broadcaster RTE.

"What we'd like to see is robust legislation introduced in the upcoming budget that make online market places jointly and separately liable to collect VAT and duties."

Elsewhere, more could be done to address the issue of commercial rates in Ireland, which have skyrocketed in recent years, forcing many businesses to contemplate closure.

On 31 January, Fianna Fáil TD Robert Troy raised the question in the Irish government (Oireachtas), saying that "a number of small retailers and people in the hospitality sector have seen a significant increase. In some cases their commercial rates have doubled and trebled.

"However, members of the Government parties assured those businesses not to worry because new legislation was coming before the Oireachtas which would ensure they would not face these new charges. Lo and behold, 1 January has come and they are now liable for these new charges. Businesses are on their knees."

In response, the Irish minister for housing, planning and local government, Eoghan Murphy, responded by saying that action on this measure is "priority legislation for this term", adding that the government "will proceed with it as quickly as possible".

In this era of 'kick the can down the road politics', however, even the smallest delay on matters like this can have a devastating effect on small businesses.

© 2018 European Supermarket Magazine – your source for the latest retail news. Article by Stephen Wynne-Jones. Click subscribe to sign up to ESM: The European Supermarket Magazine.