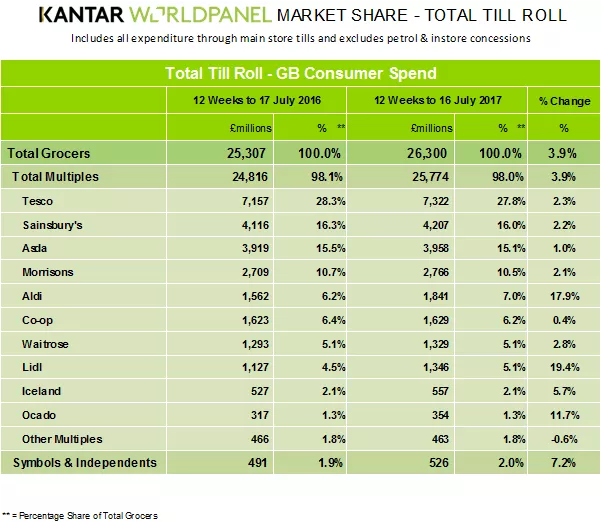

All major UK supermarkets posted growth in the 12-week period to 16 July, according to the latest market-share data from Kantar Worldpanel.

Of the UK's Big Four supermarkets, Tesco posted the strongest level of growth compared to last year, rising by 2.3%, to sit on 27.8% market share. This week, the retailer announced that it was rolling out nationwide same-day delivery, in a bid to curb the influence of Amazon on the market.

“Tesco clearly sees its online business as a crucial component of its ongoing recovery, evidenced by its move into nationwide same-day grocery delivery ahead of the competition," said Kantar Worldpanel's Fraser McKevitt. "It remains to be seen if this investment will pay off. While it has the largest share of online sales, Tesco, overall, is still losing market share, down 0.5 percentage points to 27.8% over the past 12 weeks."

Rivals

Sainsbury's saw sales rise 2.2%, to sit on 16.0% share; Asda, which, at the weekend, was linked to a purchase of discounter B&M, rose 1.0%, to sit on 15.1% share; and Morrisons rose 2.1%, to sit on 10.5% share.

“Sainsbury’s benefitted similarly from strong online custom, while its smaller Local convenience stores also contributed to the retailer’s 2.2% sales increase," said McKevitt. "After leading the move towards fewer multibuy promotions in 2016, Sainsbury’s is now aiming to further simplify its pricing by reducing price-cut deals. This approach means that only 36% of the grocer’s products are currently sold on promotion, compared to an average of 42% across its Big Four rivals.”

Discounter Growth

The fastest-growing retailers in the UK grocery market, according to Kantar, were, once again, the discounters – Aldi saw sales rise by 17.9%, to sit on 7.0% share, while Lidl rose 19.4%, to post 5.1% share. Also posting impressive growth was Ocado, which saw sales rise 11.7% (it holds a 1.3% share of the market).

Iceland’s market share remained static year on year, at 2.1%, with sales increasing by 5.7%, while Waitrose and Co-op saw sales growth of 2.8% and 0.4%, respectively.

© 2017 European Supermarket Magazine – your source for the latest retail news. Article by Stephen Wynne-Jones. Click subscribe to sign up to ESM: The European Supermarket Magazine.