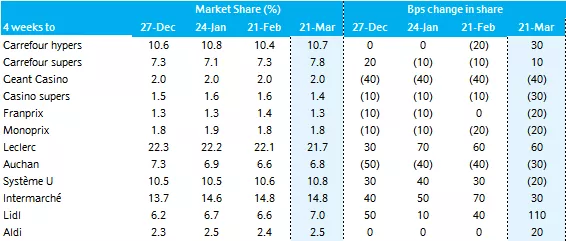

French market leader E. Leclerc saw its market share rise by 0.6 percentage points to 21.8% in the period from 22 February to 21 March, according to the latest data from Kantar.

Due to the tough comparatives with the P3 period last year, which saw the start of the COVID-19 crisis, overall grocery spend was down 11% year-on-year, Kantar said. However, the market was still at a much higher level than in March 2019 (+9%).

Some 9.5% of grocery spend was undertaken online in P3, the research firm added, an indication of the level to which e-commerce continues to be in demand by consumers. It was the only channel to see an increase during the period, said Kantar.

The market share of online increased by 1.8 percentage points, driven by bigger baskets (+9%).

Lidl Performance

As well as market leader E. Leclerc, Lidl was a big winner in the period, seeing its market share rise 1.1 percentage points to 7.0%, with the discounter boosted by a 'very significant gain' in customers, Kantar said.

Other strong performers included Le Groupement Les Mousquetaires, operators of the Intermarché banner, which saw its market share rise 0.3 percentage points to 15.8%, and Carrefour, which also achieved a 0.3 percentage point gain to give it a market share of 20.4%.

Carrefour was boosted by the performance of its online platform, which 'continues to gain ground with more customers and larger baskets', Kantar said.

Best Of The Rest

Elsewhere, Aldi reported a 0.2 percentage point gain in the period to sit on 2.5% market share, with the discounter having recruited 380,000 additional customers since the start of the year due to its takeover of the Leader Price business.

Groupement U, meanwhile, is 'keeping pace with the market', following a number of strong gains during 2020, Kantar added.

The data is taken from a sample of 20,000 Worldpanel panellist households, and covers hypermarkets, supermarkets, convenience and internet sales of grocery items.

Stockpiling Context

Commenting on the data, Barclays European Food Retail Equity Research said, "Performances during the period should be seen in the context of the stockpiling that happened last year ahead of the first lockdown implemented on 17 March 2020.

"FMCGs sales growth declined by -10.6% during the period (vs +7.1% the period before) due to a very demanding basis of comparison (they rose by 21.6% during the same period last year). Shopping patterns remained unchanged with traffic down by -10.3% at physical stores, while average basket remained high and was broadly stable yoy."

[Table: Kantar Worldpanel, Barclays Research; Pic: ©Aureliefrance/123RF.COM]

© 2021 European Supermarket Magazine – your source for the latest retail news. Article by Stephen Wynne-Jones. Click subscribe to sign up to ESM: The European Supermarket Magazine.