Moody's has said that further market share and revenue growth by discounters Aldi and Lidl over the coming years is likely to restrict the credit quality of their main competitors.

The ratings agency said that it expects more market share gains to come for the two discounters, as they strengthen their appeal to more affluent customers, with improvements in shopping experience and product quality.

'However, despite adopting some features of traditional retailers, German discounters will preserve their historical strengths, with a focus on private labels, cost-efficiency and low prices,' Moody's wrote in its report, Food & Grocery – Global: Further market share gains by Aldi and Lidl will curb incumbents' credit quality.

“While Aldi and Lidl do not publish consolidated accounts, we believe their revenues will grow faster than traditional food retailers, particularly in the UK and Australia, where they are investing heavily,” said Vincent Gusdorf, vice-president – senior analyst at Moody’s.

“Aldi and Lidl’s rapid expansion is credit negative for a lot of traditional retailers, as it will push them to keep prices down to retain customers, in turn depressing profitability,” added Gusdorf.

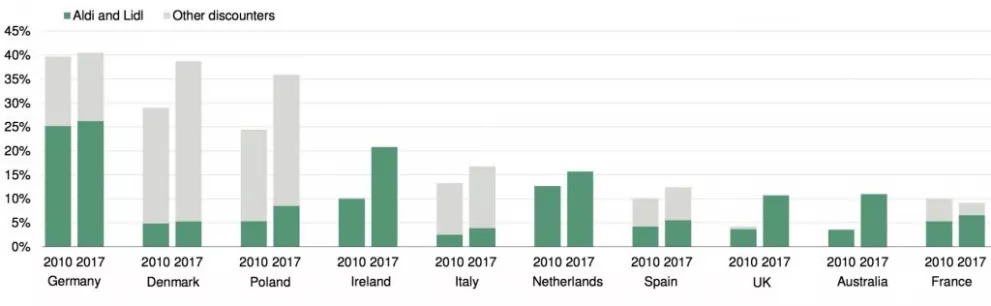

Change in market shares 2010-2017 [Sources: Euromonitor, Moody's Investors Service]

European Markets

In many markets, price competition will be a limiting factor towards the discounters' continued rapid expansion, which, in turn, will limit credit quality erosion for most incumbents.

'In many Continental European markets, such as France, Spain and Belgium, pressure to cut prices or keep them low mostly comes from market leaders such as Leclerc, Mercadona and Colruyt,' Moody's noted. 'This leaves little room for discounters, although Lidl should continue to expand.'

In Germany, significant market share gains are also unlikely, as the discount segment is already mature, however, continued fierce competition will limit the margin gains of other retailers, such as Metro AG, which is expected to see 'only a limited increase' in its margins in 2018.

In the UK, however, the expansion of the discounters is likely to continue at a similar level, even as the credit quality of retailers Tesco Plc and Wm Morrison Supermarkets plc improve in the next 12 months, 'thanks to cost savings and new revenue streams,' according to Moody's.

'That said, even their credit quality could begin to feel the strain in two to three years if they continue to lose market share to unabated German discounters' growth and they are not able to offset it with new revenue streams and further cost efficiencies,' it further noted.

Down Under

In Australia, where Aldi recently announced a major push, competitors including Woolworths Group Limited and Wesfarmers Limited 'should improve their credit metrics over the next 12 months after increasing their market share in 2017,' Moody's added. 'However, Aldi will continue to expand, depress prices and squeeze incumbents' profitability.'

The full report is available at www.moodys.com.

© 2018 European Supermarket Magazine – your source for the latest retail news. Article by Stephen Wynne-Jones. Click subscribe to sign up to ESM: European Supermarket Magazine.