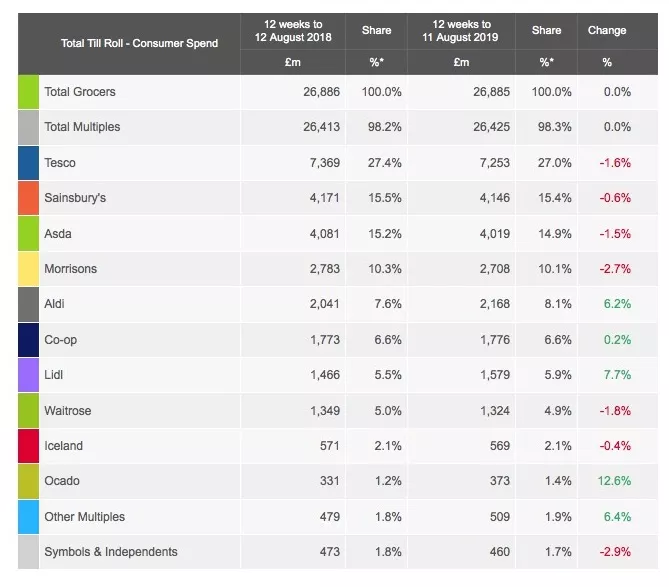

The UK's 'Big Four' supermarkets, Tesco, Sainsbury's, Asda and Morrisons, all saw their sales decline in the 12 week period to 11 August 2019, compared to the same period last year, according to the latest market share figures from Kantar.

Market leader Tesco saw a 1.6% decline in sales to sit on 27.0% market share, while second-placed Sainsbury's saw a 0.6% drop in sales to sit on 15.4% share, and Asda, in third, saw a 1.5% drop to sit on 14.9% share.

Fourth-placed Morrisons saw the biggest decline in sales in the period, of 2.7%. The Bradford-based grocer sits on 10.1% market share.

Not All Bad

Commenting on the performance of the Big Four, Fraser McKevitt, head of retail and consumer insight at Kantar, said, “While each of the big four lost share, Sainsbury’s will be cheered to be the strongest performer among this cohort for the first time since November 2017. Bucking the market-wide own-label trend, sales of branded goods at Sainsbury’s rose by 1.5%, driven by higher levels of promotion and its price lockdown strategy.”

Similarly, while Asda and Tesco saw sales drop, it "wasn't all bad news" for both grocers, as "Asda’s online growth of 11% was notably strong while Tesco continues to find success with its cheapest own-label lines. In fact, total sales of Tesco’s value tier were £29 million higher than this time last year.”

Discounter Drive

The discounters, Aldi and Lidl, were among the strongest performers according to the latest data, seeing a 6.2% and 7.7% increase respectively. Aldi now holds 8.1% market share, while Lidl is on 5.9%.

"Lidl’s raft of new store openings has helped it attract 489,000 additional shoppers this period," said McKevitt. "Its campaign to encourage people to do their main weekly shop at Lidl is making an impact and the average basket spend is now nearly £19, 3% higher than last year, though still significantly lower than the £22.65 average spend at the big four."

Elsewhere, Aldi benefited from the fact that "nearly half of all households shopped in an Aldi during the past 12 weeks, showing the extent to which the discounter has established itself in our retail landscape," he added.

The strongest grocer in the period was Ocado, which saw a 12.6% increase in sales, albeit off a small base, to hold 1.4% market share. The online retailer increased its shopper base by 7% and encouraged its customers to spend £1.93 more each delivery, according to Kantar, while it commands 18% of all online supermarket sales.

Tough Comparatives

Overall, supermarket sales at the UK's grocers were flat year-on-year, at £26.885 billion, due to tough comparatives with the previous summer.

“July’s hottest day on record wasn’t enough to shift the market into growth, but the grocers will have been encouraged by glimpses of better weather during the past four weeks which helped boost sales of summer staples like hayfever remedies, suncare and burgers by 17%, 8% and 5% respectively," said McKevitt.

Grocery inflation stood at 0.9% for the 12-week period to 11 August 2019.

© 2019 European Supermarket Magazine – your source for the latest retail news. Article by Stephen Wynne-Jones. Click subscribe to sign up to ESM: The European Supermarket Magazine.