A new report by Moody's has found that diverging consumer income trends in different European markets are likely to have credit implications for European retailers, particularly those with a broad portfolio of stores in a number of European markets.

Moody's said that currently, income inequality remains 'broadly stable' in the EU as a whole.

However, while the income among Eastern European consumers increases, incomes are stagnating or even declining in many western and Southern European countries.

Impacted Segments

In these regions, segments such as apparel, electronics and furniture are likely to 'suffer the most' says Moody's, meaning that retailers with extensive non-food offerings may be impacted.

At the same time, mature segments such as food and beauty still offer opportunities for growth in northern and Eastern Europe, Moody's added, benefiting retailers such as ICA in Sweden and Jerónimo Martins in Poland.

Regional Disparities

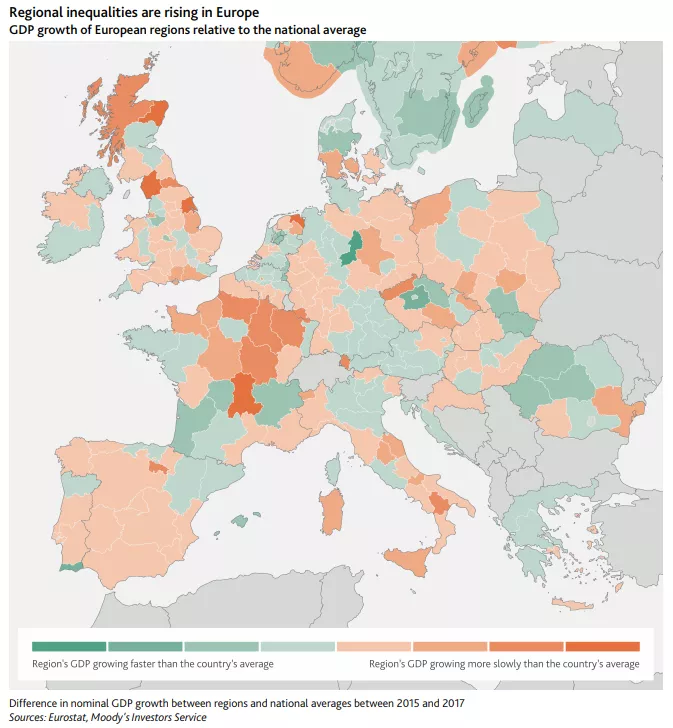

"Regional disparities are rising in many western and southern European countries, compelling incumbents with nationwide brick-and-mortar networks to close shops in declining regions," said Vincent Gusdorf, Vice President – Senior Analyst at Moody’s.

"This will involve significant restructuring charges and possibly large payments to landlords to cut short long leases. Increasing urbanisation will constrain retailers' ability to cut investment because they need to open convenience stores and strengthen their online operations. All that will depress free cash flow, which are already low in the industry."

With stalling incomes, workers are likely to change their shopping habits, buying more from the discounters, and also increasingly buying during promotional and sale periods.

"Younger generations, which are especially vulnerable to unemployment will suffer most, [are] a credit negative for retailers," Gusdorf added. "Most retailers will not benefit from the rising spending power of pensioners because this group purchase fewer goods than younger people."

At the same time, the broad reach of luxury firms is likely to offset slowing growth across Europe, with firms such as LVMH and Richemont in a position to grow faster than traditional retailers despite limited growth in the incomes of the richest Europeans, Moody's said.

© 2019 European Supermarket Magazine – your source for the latest retail news. Article by Stephen Wynne-Jones. Click subscribe to sign up to ESM: The European Supermarket Magazine.