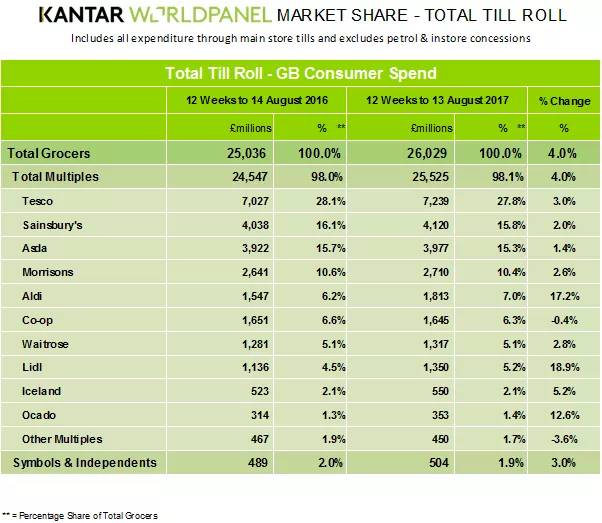

All of the UK’s ‘Big Four’ supermarkets posted growth in the latest Kantar Worldpanel market-share figures for the 12-week period to 13 August, with Tesco seeing a 3.0% rise, to sit on 27.8% market share.

Sainsbury’s (+2.0%) is on 15.8% share, followed by Asda (+1.4%), on 15.3% share, and Morrisons (+2.6%), on 15.3% share.

“All four of Britain’s biggest grocers managed to grow sales for the fifth consecutive period – a run of collective success not seen since 2013,” said Kantar Worldpanel’s Frazer McKevitt.

Discounter Pressure

“However, this welcome period of sustained growth hasn’t been enough to entirely offset pressure from the discounters. The Big Four now account for just 69.3% of the UK grocery market, down from 76.3% five years ago, and that looks set to fall further in the coming months.”

Aldi, which saw sales rise by 17.2%, now holds 7.0% of the market – up from 6.2% in the same period last year. Similarly, Lidl, which posted an 18.9% rise, is now on 5.2% share, up from 4.5% a year earlier, which has pushed it above Waitrose for the first time.

“Lidl is growing sales 40% faster with families than with households without children,” said McKevitt. “Families tend to buy more items each time they shop, so strong growth with this demographic has helped Lidl to increase its average basket size year on year.”

Grocery Inflation

Like-for-like grocery inflation increased slightly, to 3.3%, after holding steady at 3.2% for the past two months.

“At the current rate, price increases could add a further £138 to the average household’s annual grocery bill, with the price of butter and fish most affected,” Kantar Worldpanel said.

One retailer that appears to be turning its fortunes around, according to the data, is Asda. “[After a difficult couple of years, it has] managed to continue the run of positive sales performance which began in April this year – up 1.4% during the latest quarter,” said McKevitt. “This follows the retailer’s recent announcement of a return to like-for-like sales growth, suggesting Asda is asserting its recovery across the board.”

© 2017 European Supermarket Magazine – your source for the latest retail news. Article by Stephen Wynne-Jones. Sign-up for a subscription to ESM: The European Supermarket Magazine.