Sales in UK supermarkets fell by 1.6% in the 12-week period to 13 June, as shoppers began to 'inch back' to their pre-pandemic shopping habits, Kantar has said.

Since last year, there has been a 13.1% increase in the number of shopping visits being made by consumers, while spend per trip is also down, by 13.6%, an indication of a return to more typical patterns.

In the most recent four weeks, for example, the number of shopping trips was down by five million visits, with the reopening of indoor hospitality across the UK taking spend away from the grocers.

Returning To Normal

“While it’s encouraging to see shoppers returning to the habits of old, there is still a way to go before the market entirely returns to normal," commented Fraser McKevitt, head of retail and consumer insight, Kantar.

"That’s demonstrated by the fact that sales in the past 12 weeks were still £3.3 billion (€3.85 billion) higher than in 2019, before the pandemic hit. Retailers will also be benefiting from sales of goods consumed on-the-go, such as picnics and lunches eaten at work, which are not captured in these numbers.”

Online sales have remained at an elevated level, however, accounting for 13.4% of sales in the four weeks to 13 June, the same figure as in May – suggesting that online is achieving a new baseline level, according to Kantar.

“A really interesting recent development in online shopping is the rapid growth of fast-track delivery services for smaller top-up shops," said McKevitt. "Tesco launched its Whoosh platform in May to compete against start-up disruptors including Gorillas, Getir and Weezy, which are moving into the market for smaller trips."

Retailer Performance

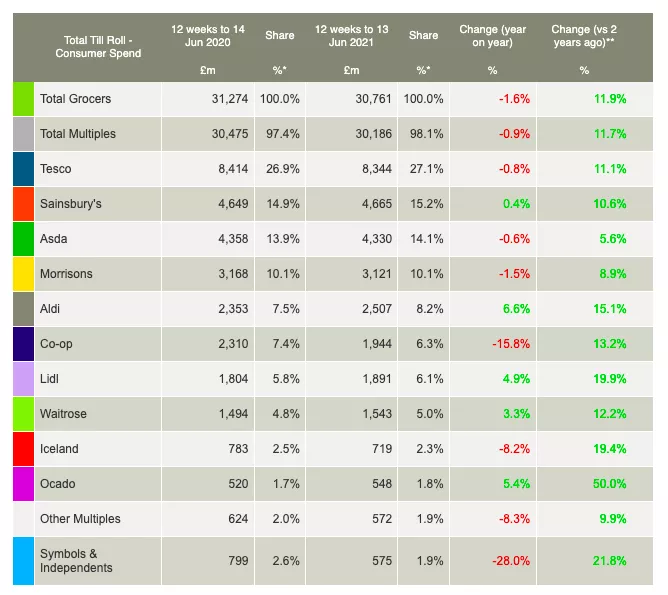

In terms of the performance of the UK's biggest grocers, tough comparatives were evident, as Tesco (27.1% market share) saw a 0.8% decline in sales in the 12-week period, while Sainsburys (15.2% market share), was up 0.4%.

Fellow 'Big Four' operator Asda (14.1% market share) saw a 0.6% drop in sales, while Morrisons (10.1% market share) saw sales dip 1.5%.

The best performer in terms of year-on-year sales growth was Aldi, which saw sales up 6.6%. The discounter sits on 8.2% market share.

"Much of its gains came from older shoppers who, having been vaccinated, are now more confident about visiting stores," said McKevitt. "Aldi’s market share increased as a result by 0.7 percentage points to 8.2%, matching its highest ever in March 2020."

Online player Ocado (1.8% market share) saw its growth slow to 5.4% as demand for online grocery levels off, however the retailer's sales are 50.0% higher than at the same period two years ago.

© 2021 European Supermarket Magazine. Article by Stephen Wynne-Jones. For more Retail news, click here. Click subscribe to sign up to ESM: European Supermarket Magazine.