UK online grocer Ocado Group turned to the debt markets to help fund its domestic expansion, seeking £200 million ($254 million) in what would be its debut bond sale.

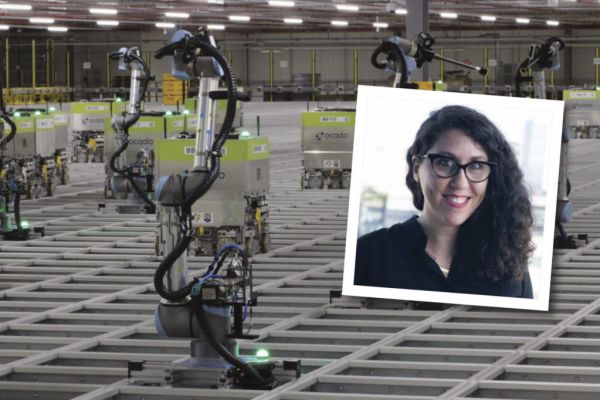

The company, which has yet to show much payback on the hundreds of millions of pounds it has invested since a 2010 share offering, will use proceeds of the seven-year notes to increase UK warehouse capacity and make improvements to its technology platform, it said in a statement Monday.

The note issue meets a key need for Ocado, which continues to plow money into expansion despite generating little in the way of profit.

The company is relying on licensing its grocery storage and distribution technology to international supermarkets, signing the first such deal with an as-yet unnamed European retailer earlier this month. The scope of that agreement underwhelmed investors and reignited concern that more sizeable deals may not materialise.

Current Trading Figures

The bond sale “highlights the issue that has been there the whole time with Ocado, which is it has to invest a lot of money and keeps running out of cash,” Charles Allen, an analyst at Bloomberg Intelligence, said by phone.

The shares fell 2.6% to 282.4 pence as of 10:13 am in London, extending their decline this month to 10%.

Ocado also gave an update on current trading, showing that the company broadly maintained sales growth in the last two months. Average weekly gross retail sales were £27.3 million in the 22 weeks ended 30 April, up 13% compared with a similar period of last year. Pretax profit for the period was £6.7 million.

Ocado said it will hold roadshows with debt investors on Tuesday and Wednesday. The proposed offering would be its first bond, as all previous borrowings have been loans, data compiled by Bloomberg show.

The plan is the third high-yield bond sale announced on Monday, as the cost of borrowing for junk issuers in Europe is near to the lowest it has ever been.