Ocado Group Plc’s shares fell the most in more than two months, as the online grocer said that profits will likely fall below analysts’ estimates, showing the effects of a damaging UK price war.

Chief financial officer Duncan Tatton-Brown said that he “wouldn’t be surprised” if analysts cut their estimates for the company’s full-year earnings before interest, tax, depreciation and amortisation, as persistent UK food deflation pressures its margins. The shares fell as much as 12.2% in early London trading, the most in almost three months.

Ocado is mired in a long-standing price war with mainstream chains such as Tesco Plc and Wm Morrison Supermarkets Plc, as Britain’s grocers struggle to fend off discounters Aldi and Lidl. The online retailer is also facing heightened competition from Amazon.com, Inc., which recently extended its Fresh grocery delivery service across most of London.

“There aren’t many retailers who can turn a blind eye to Amazon turning up in their backyard, and Ocado are no exception,” said George Salmon, an analyst at Hargreaves Lansdown. “Despite higher sales and order numbers, competitive forces are likely to keep margins under pressure for some time.”

Estimate Cut

The company should generate profit of about £90 million ($120 million) this year, according to analysts polled by Bloomberg. In a conference call, Tatton-Brown said that Ocado is “well placed” to absorb the margin pressure. Still, Jefferies analyst James Grzinic cut his profit estimate by between 6% and 7%, to about £86 million, as “deflationary pressures had a greater than feared impact”, he said in a note.

Third-quarter sales rose 14%, slightly missing estimates, as a 3.4% decline in average order size partially offset a 19% uptick in orders per week, Ocado said in a statement.

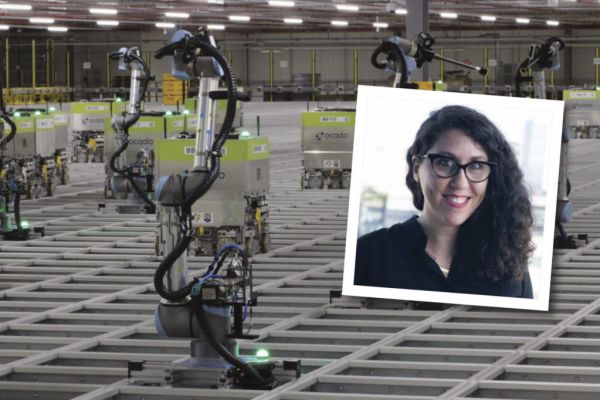

Ocado also failed to provide any update on a deal to license its technology to an international retailer, something that it has been seeking to do for more than three years. “The silence is deafening,” Nick Bubb, an independent retail analyst, said by email. The company remains confident of signing multiple deals with more than one retailer in the medium term, Tatton-Brown said.

News by Bloomberg, edited by ESM. To subscribe to ESM: The European Supermarket Magazine, click here.