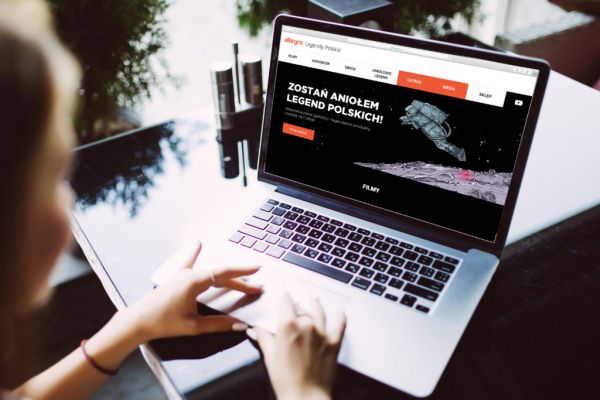

Poland's e-commerce platform Allegro reported forecast-beating third-quarter net profit, but stuck to its guidance and flagged 'softer' margins next year as it pushes on with investments, sending its shares down.

Allegro, which has become the go-to online marketplace in Poland and is enjoying a sales boom accelerated by the pandemic, has been investing in logistics and fintech to gain a competitive edge and create new revenue streams.

The company said the priority was to invest in GMV (gross merchandise value) growth through retail basics and scaling Allegro Pay, Allegro APM and Allegro fulfilment operations, but that operating margins might be softer in 2022.

Its shares, which have lost more than 40% so far this year amid competition jitters, were down 6% as of 09:44 GMT.

"This is another quarter comparable somewhat to the second quarter in terms of lockdowns, in that shopping malls were closed throughout November last year," chief financial officer Jon Eastick told Reuters.

"We therefore expect GMV growth rate to be a bit lower in percentage terms than last year. The absolute sales level is looking very promising and we're looking forward to a very successful Christmas sales period."

Third Quarter Performance

Allegro swung to a third-quarter net profit of 324.4 million zlotys ($81.58 million), from a loss of 132 million zlotys a year ago, and above analysts' forecast of 263 million zlotys.

Gross merchandise value, an industry metric to measure transaction volumes, jumped 19.9% to 9.9 billion zlotys, as consumers continued to shop online despite the easing of pandemic-related restrictions.

But the company's adjusted EBITDA/GMV (earnings before interest, taxes, depreciation and amortisation) margin slipped to 4.77% from 4.95% amid higher costs.

'Quite Low' GMV

Lack of guidance upgrade implies 'quite low' GMV and adjusted EBITDA dynamics in the fourth quarter, mBank brokerage analyst Pawel Szpigiel told Reuters.

"Additionally, the management underlined the priority to invest in GMV growth in 2022, which we treat as a sign the profitability will decline," he said.

Eastick said a plan to roll-out 3,000 of Allegro's own parcel lockers by 2022 is well on track. He also said the group's new Allegro Pay product was looking to be a very promising GMV driver, with a typical Allegro Pay customer spending about 35% more than they did before they joined Allegro Pay.

Eastick said he was not too worried about the supply chain and logistics issues hitting many retailers, as Allegro can source products through multiple suppliers and merchants to its platform.