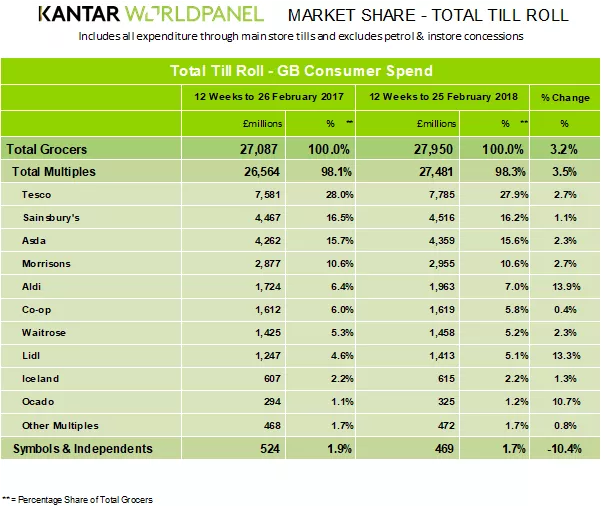

Tesco and Morrisons were the best performers out of the UK’s ‘Big Four’ supermarkets, according to the latest Kantar Worldpanel figures for the 12 weeks to 25 February 2018.

Both retailers posted 2.7% growth for the period, compared to the same period last year.

Tesco remains the UK’s biggest supermarket group, accounting for 27.9% of the market, with Sainsbury’s in second place, on 16.2% market share (1.1% growth), and Asda on 15.6% share (2.3% growth). Morrisons remains fourth, on 10.6% share.

“Tesco continues to perform well – more positive news, following approval of its Booker acquisition last week,” said Fraser McKevitt, head of retail and consumer insight at Kantar Worldpanel. “Despite a slight fall in market share, of 0.1 percentage points, Tesco experienced particularly strong growth from its Extra superstores.

“The varied selection of groceries on offer at these larger stores has encouraged customers to return to fuller trolley shops, with average baskets worth £31.09 – currently the highest value in the bricks-and-mortar market,” McKevitt added.

Private-Label Focus

Both Asda and Morrisons have benefitted from a renewed focus on their private-label selections.

“Asda has also encouraged shoppers to choose own-label alternatives, which are up by 6.4% year on year,” McKevitt added.

“Less than a year since its launch, the retailer’s Farm Stores range is bought by 30% of all British households, with sales surpassing £50 million, while its premium Extra Special line increased sales by 19%,” he said.

At Morrisons, sales of its premium range, The Best, are up 20% year on year.

Strong Performers

Aldi, which saw its saes grow by 13.9% year on year, and Lidl, whose sales grew by 13.3%, remain the retailers that have posted the strongest growth for the period. They sit on 7.0% and 5.1% market share, respectively.

An honourable mention should also go to Ocado, which, despite its low market share (1.2%), has posted a double-digit growth in sales, of 10.7%.

The period also saw the first return to growth for the Co-op since July 2017, seeing its sales go up by 0.4%, to sit on 5.8% market share. The retailer is currently embarking on a store refurbishment programme, as well as an opening drive in London.

Inflation Growth

Grocery inflation stood at 2.9% for the period, which means that prices have been rising since the 12 weeks to 1 January 2017.

This followed a series of 30 consecutive periods of grocery price deflation, which ran from September 2014 to December 2016. Prices are rising fastest in categories including butter and fresh fish and pork.

The current period saw grocery sales increase in value by 3.2%, compared to the same period last year.

This marks the 12th consecutive period in a row that total market sales have exceeded 3%.

© 2018 European Supermarket Magazine – your source for the latest retail news. Article by Stephen Wynne-Jones. Click subscribe to sign up to ESM: The European Supermarket Magazine.