The latest UK market-share figures from Kantar Worldpanel have shown that all major supermarket groups are currently in growth, with the data firm reporting the highest sales growth for the industry for five years.

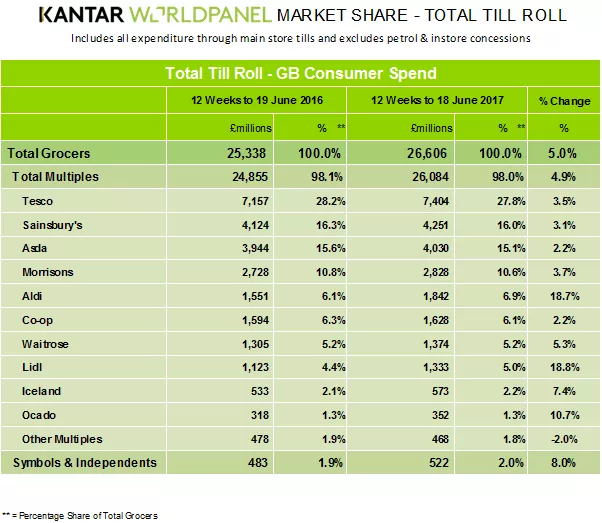

For the 12-week period to 18 June, supermarket sales growth accelerated to 5.0%, which was the strongest increase since March 2012.

It is also a marked improvement on the same period last year, when the market posted a 0.2% decline.

“The market’s robust performance this period is partly down to particularly weak sales growth last year and a continuing increase in like-for-like grocery inflation, which is now running at 3.2%,” said Fraser McKevitt, head of retail and consumer insight at Kantar Worldpanel. “At this rate, that’s an extra £133 on the average household’s annual shopping bill, or the equivalent of seven additional shopping trips a year.”

Big Four

In terms of the performance of the UK’s largest grocers, Morrisons posted the strongest growth of the Big Four, with a 3.7% rise, to put it on 10.6% market share.

Tesco continues to top the list, with 27.8% market share, posting a 3.5% increase in sales for the period. Sainsbury’s, on 16.0% share (a 3.1% increase), and Asda, on 15.1% share (a 2.2% increase), are second and third, respectively.

“Tesco has attracted a further 369,000 shoppers and increased sales across all channels, rising fastest online and through its Extra stores,” said McKevitt. “Despite being in growth for most of the past 12 months, its market share now stands at 27.8%, down 0.4 percentage points since June 2016.”

The biggest sales growth overall was seen at Lidl, which posted 18.8% growth, followed by Aldi, which posted 18.7% growth.

“Lidl has pipped Aldi to the title of the UK’s fastest-growing supermarket for the first time since March, with sales growth of 18.8%, just ahead of the latter’s 18.7%,” said McKevitt. “Both retailers continue to gain market share. Combined, the two have gained 1.4 percentage points since June 2016 and now hold 5.0% and 6.9%, respectively.”

© 2017 European Supermarket Magazine – your source for the latest retail news. Article by Stephen Wynne-Jones. Click subscribe to sign up to ESM: The European Supermarket Magazine.