Online retailer Ocado has posted a 10.3% increase in retail revenue in the first quarter of its financial year, to £441.2 million (€470.5 million), with the business seeing higher value basket spend towards the end of the period due to the coronavirus.

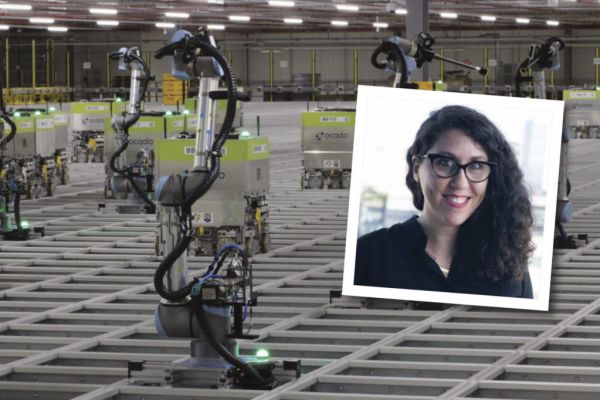

"The impact of higher basket values and order demand, amid growing public concern over the coronavirus, was limited in the quarter, although this has since picked up significantly and growth in the second quarter is so far double that of the first quarter," commented Melanie Smith, Ocado Retail's chief executive.

Here's how leading industry analysts viewed the group's performance:

Nigel Frith, www.asktraders.com

"There aren’t many positive stories surrounding coronavirus in the financial markets, but Ocado is definitely one of them. The online retailer reported a rise in Q1 revenue amid a massive surge in online orders as people stockpile amid the coronavirus outbreak.

"This is unlikely to stop here, Q2 revenues will also surge, particularly as London is expected to go into lock down, possibly as soon as the weekend. Panic buying and stockpiling will continue for as long as the number of coronavirus cases continue to rise.

"This will of course unwind at some point, but for now revenue is set to keep rising. The share price has soared over 30% so far this month as investors price in the higher demand. In a classic case of buy the rumour sell the fact, the share price is down over 1% in trade today, despite the FTSE rising."

Thomas Brereton, GlobalData

"Somewhat surprisingly, Ocado has kept FY2020 revenue growth in line with its previous estimates, expecting 'the impact of forward buying to unwind at some point'. However, this contrasts with the wider expectation that the online food & grocery market will (in 2020) grow significantly ahead of pre-outbreak estimates – anticipated due to UK consumers opt to shop online to avoid large supermarkets – and points more to Ocado’s own constrained capacity to fulfil orders.

"Ocado is not alone in facing these issues; at the time of publication, the transactional websites of rivals Waitrose and Sainsbury’s are also down. And while ASDA, Tesco and Morrisons are still persevering with online orders, the earliest available delivery slot (to central London) for all three is the end of the first week of April.

"From this, it is clear in this sense that COVID-19 is providing a severe, unwanted stress test on the operational efficiency of the online grocery sector, and it is one that Ocado is struggling to deal with.''

Bruno Monteyne, Bernstein Research

"Revenue growth come in at 10.3%, the lower end of the 10% to 15% range. This is probably due to the fact that Q1 covers Christmas and is the period where increasing capacity is the hardest. That growth is below our 12% forecast, but still by far the fastest growing retailer in the UK, and the only constraint on growth is the rate at which they can add capacity.

"Coronavirus. Demand is indeed off the charts; all slots are fully booked for several days and Ocado had to take the exceptional step of closing its website for several days. Whilst that should provide a boost to demand, Ocado is not yet changing its sales growth guidance for the year.

"Long term impact of Coronavirus: The biggest impact will be the increase in grocery ecommerce penetration worldwide. Getting consumers to trial out a new service is always the hardest first step. Right now, most of the world are doing their first grocery ecommerce shop. There is global mass trial. This global mass trial will accelerate grocery ecommerce penetration, and that is one of the biggest drivers of value for Ocado."

Clive Black, Shore Capital

"Revenues in Retail, noting that Marks & Spencer (‘M&S’) has 50% ownership and as such seems to carry little value in the Ocado Group’s share price whatsoever, grew by 10.3%, representing average orders per week of 343k, up by 10.2%, and a 0.3% advance in average order size to £110.24.

"As to more current trade, impacted by the terrible Coronavirus, Ocado speaks of sales doubling, so c20%, reflecting the somewhat capacity constrained nature of the business, with its central fulfilment model, as the UK supermarkets to us grow sales by a faster margin at present in our view.

"Indeed, Ocado Retail is letting a lot of its customers down at this very peculiar and remarkable time and as such has had to introduce measures to control demand. As such new customer registration has been halted, queueing systems have been introduced and the app has been closed down temporarily, going onto close its webshop from yesterday."

© 2020 European Supermarket Magazine – your source for the latest retail news. Article by Stephen Wynne-Jones. Click subscribe to sign up to ESM: The European Supermarket Magazine.