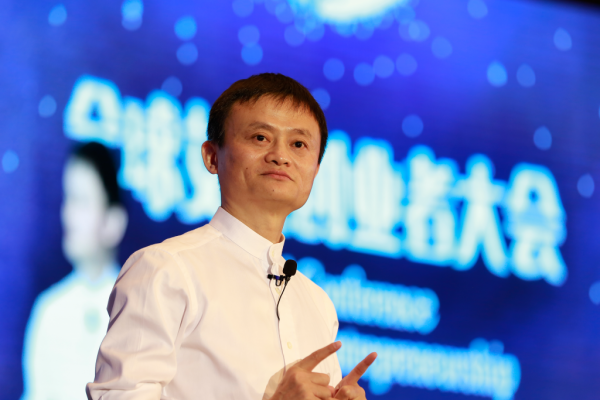

Jack Ma, who launched China’s largest e-commerce company two decades ago and rode it to a $47.6 billion fortune, turns out to have created billions of dollars of wealth for at least 10 others -- a total of almost $100 billion.

By investing directly in or partnering with companies that provide services for his online buying platforms -- from payment systems to delivery companies -- Ma and his Alibaba Group Holding Ltd, which celebrated a successful Singles Day last weekend, have minted a network of people whose combined fortunes total more than $52 billion, according to the Bloomberg Billionaires Index. With Ma’s wealth included, the collective net worth is larger than the economies of 136 countries.

'Visionary'

"Jack is a long-term visionary," said Duncan Clark, author of the book Alibaba: The House That Jack Ma Built and an early adviser to the company. The network of companies all feeding Alibaba at the center "is something Jack Ma envisioned and planned from a long time ago."

The fortunes have emerged from Alibaba’s supporting industries -- e-payments and insurance, delivery companies and complementary retailers such as supermarkets.

At least two billionaires have emerged this year from the fintech world supporting Alibaba. One of them is Ou Yafei, of ZhongAn Online P&C Insurance Co., which offers customers shipping return insurance through a click of a button for purchases on Alibaba’s Taobao online mall. The company, which counts Alibaba’s online payments business, Ant Financial, as its largest shareholder, had an initial public offering in Hong Kong in September. Min Luo from Qudian Inc., which provides credit loans to online shoppers in partnership with Ant Financial, had an IPO in the U.S. in October.

Parcel delivery has also created six billionaires. Wang Wei, who started China’s largest parcel delivery company by revenue, SF Express, added more than $15.4 billion to his net worth this year after his SF Holdings Co. became publicly traded on the Shenzhen Stock Exchange.

Delivering Goods

The company has primarily made its money shipping Alibaba’s goods, as have the delivery companies of ZTO Express Cayman Inc., STO Express, Yunda Holding Co. -- and YTO Express Group Co., which has an 11 percent ownership stake from Alibaba. The companies also cooperate in a logistics network called Cainiao Smart Logistics Network Ltd., which is majority owned by Alibaba.

“Alibaba’s e-commerce business is a more open system, connecting different parties from the supply chains,” said John Wu, Alibaba’s former group chief technology officer and co-founder of Singapore-based venture capital firm and hedge fund FengHe Fund Management.

He compared Alibaba with Tencent Holdings Ltd., China’s biggest operator of online games, which along with Alibaba and Baidu Inc. dominate China’s tech industry. Tencent "relies on a gaming business that follows a closed production circle of engineers’ design and development,” Wu said.

Alibaba co-founder and vice chairman, Joseph Tsai, is the second-richest person to come from the Hangzhou-based company, with a net worth of $11.5 billion, according to the Bloomberg index. He recently agreed to buy a stake in the Brooklyn Nets after earlier buying a lacrosse team in California.

Ant Financial

In addition to the 10 billionaires, Ant Financial created more than a dozen more, based on Bloomberg reporting from 2015, when Ant was valued at $50 billion. The company’s shareholder structure has changed since then and ownership details aren’t clear – and may not be until its planned initial public offering -- meaning that it’s unknown how many people associated with Ant Financial are billionaires. Alibaba has the right to acquire as much as 33 percent of Ant, which was valued at $60 billion in its last funding round, subject to regulatory approval.

Ma started Alibaba in 1999 at his home in Hangzhou, creating the “Alibaba Partnership.” According to the company’s 2014 prospectus, it includes five executives from Ant Financial, and one from delivery platform China Smart Logistics. The members of the partnership control 350 million shares that, once fully vested, are valued at $65.2 billion today. Ma and Tsai have stakes valued at $38.9 billion.

A spokesman for Alibaba and Ant Financial declined to comment on the wealth creation. Representatives of YTO, STO, Yunda, SF Express, ZhongAn and Qudian declined to discuss the wealth of their founders or primary shareholders. An external investor relations representative of ZTO, Christian Arnell, said, "Neither company would be able to grow at the rapid rates that they do would the other not exist."

News by Bloomberg, edited by ESM. Click subscribe to sign up to ESM: The European Supermarket Magazine.