A group of investors in Unilever said on Thursday they had filed a fresh resolution urging the company to fix a 'crucial blind spot' in its strategy and set ambitious targets to sell healthier foods.

The resolution by an 11-strong investor group with $215 billion in assets, including Candriam, Actiam and Greater Manchester Pension Fund, calls on Unilever to disclose the current proportion of sales linked to healthier products.

It also urges the company to set a target to 'significantly increase' that share by 2030, and publish an annual review of their progress.

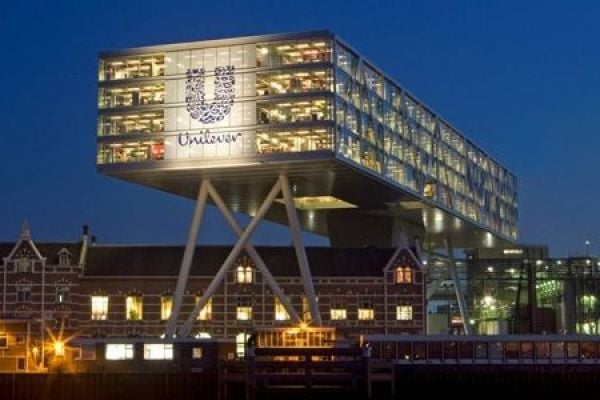

While Unilever, owner of the Ben & Jerry's ice cream, Hellmann's mayonnaise and Pot Noodle brands, is seen as a leader in sustainable business by many funds, the investors said increasing regulations around health meant a failure to act could hit its finances.

Governments in many of the company's main markets have introduced taxes on products high in sugar or calories as obesity levels rise.

'A Sustainability Leader'

“Unilever has long been a sustainability leader. Some even criticise it for being too focused on ESG. Yet the health profile of the food and drink products it sells remains a blind spot," said Ignacio Vazquez, a senior manager at responsible investment NGO ShareAction, which co-ordinated the resolution.

British fund manager, Terry Smith, whose Fundsmith vehicle is a top-10 Unilever investor, lambasted Unilever last week for being "obsessed" with promoting its sustainability credentials at the expense of performance.

"By voicing their support for this resolution, Unilever's investors can help to drive change at the heart of one of the biggest foods and drink manufacturers in the world while also shielding themselves from regulatory and reputational risks,” Vazquez said.

The move follows similar calls for action at last year's AGM, which ShareAction said had not resulted in much progress.

'High Nutritional Standards'

While Unilever said that in 2020, 61% of its food and drink sales were of products with 'high nutritional standards', the investors said they questioned its metrics.

"It is key that a company with such a scale of leverage and capacity demonstrates efforts to set its targets and disclosures on the basis of government-endorsed nutrient profiling models where it operates," Sophie Deleuze, lead ESG analyst of engagement & voting at Candriam, told Reuters.

Deleuze urged Unilever to conduct and outline their risk profile in countries where it operates, factoring in aspects including existing and upcoming regulatory pressures, the health profile of customers, and their product preferences as a basis for reformulation.

The move comes at a turbulent time for the company, which late on Wednesday effectively abandoned a £50 billion ($68.11 billion) proposal to buy the consumer health unit of GlaxoSmithKline.

Promoting healthy food and drink has become a hot-button issue for investors. Late last year, investors managing 12.4 trillion in assets urged policymakers to use fiscal and regulatory measures to help fix what they described as a "global nutrition crisis".

News by Reuters, edited by ESM. For more A-Brands news, click here. Click subscribe to sign up to ESM: European Supermarket Magazine.