Supermarket group Ahold Delhaize has trimmed its 2023 earnings guidance and flagged margin weakness in the United States, its main market.

European retailers, whose profits have been boosted by the rising cost of everything over the past two years, are seeing their margins squeezed as food price inflation falls while consumers continue to restrain their spending in an uncertain economic environment.

The group, which operates the Stop & Shop, Giant, Food Lion and Hannaford chains in the U.S. and the Albert Heijn and Delhaize chains in the Netherlands and Belgium, expects 2023 underlying earnings per share to be slightly below last year's level.

It had previously forecast annual earnings in line with 2022.

Read More: Getir Acquires FreshDirect From Ahold Delhaize USA

US Margins

Margins in the U.S. grew less than expected in the third quarter, Ahold said in a statement, but added it expected this pressure to be transitory and pass in a couple of quarters.

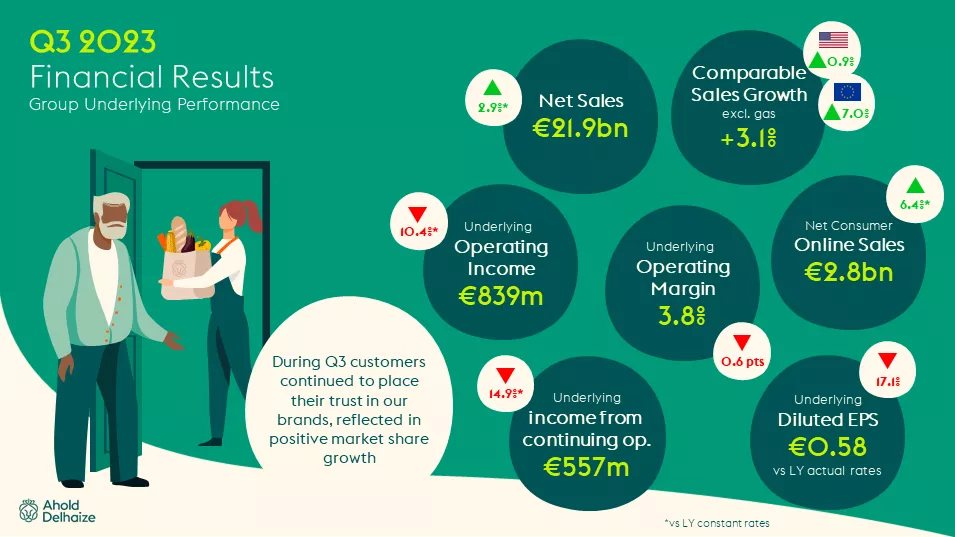

At group level, sales totalled €21.9 billion – a 2.9% increase at constant rates.

Comparable sales growth was up 3.1%, with the group seeing 0.9% growth in the US, and 7.0% growth in Europe.

Cash Flow Guidance

The company raised its 2023 cash flow guidance for the second time this year, citing significant improvements in working capital management by its brands.

It now sees annual free cash flow in a range of €2.2 billion to €2.4 billion, up from a prior guidance of between €2 billion and €2.2 billion, last raised in August.

Ahold Delhaize also said it would launch a €1 billion share buyback programme at the beginning of 2024.

"I am proud of how we have adapted to the evolving market conditions and taken well-thought-through strategic decisions to steer our company towards its long-term potential," commented Frans Muller, chief executive. "We have done all of this while, at the same time, delivering superior free cash flow, as can be seen in our increased guidance for 2023."

Additional reporting by ESM