British households are facing a cost-of-living squeeze, according to Kantar, with grocery price inflation in the UK currently standing at 3.8%, a 0.3 point rise from December.

"Prices are rising on many fronts, and the weekly shop is no exception. Like-for-like grocery price inflation, which assumes that shoppers buy exactly the same products this year as they did last year, increased again this month," commented Fraser McKevitt, head of retail and consumer insight at Kantar.

"Taken over the course of a 12-month period, this 3.8% rise in prices could add an extra £180 (€215.43) to the average household’s annual grocery bill."

Read More: Euro Zone December Inflation Confirmed At Record 5.0% On Energy Surge

Supermarket Sales Decline

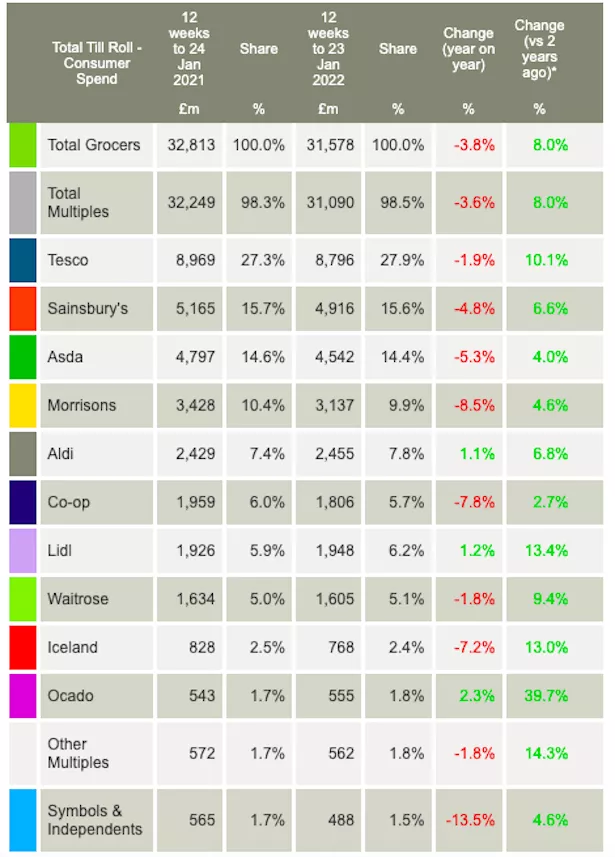

Kantar made the assessment as it announced that supermarket sales fell by 3.8% in the 12 weeks to 23 January 2022 – a period that reflects tough comparisons with the strict lockdowns implemented at the start of last year.

Compared to the pre-pandemic period, sales were up 8%.

In terms of the performance of the UK's largest grocers, just three retailers recorded year-on-year growth in the period: Aldi (7.8% market share), which saw sales up 1.1%; Lidl (6.2% market share), which saw sales rise 1.2%; and Ocado (2.3% market share), which saw sales up 2.3%.

'Big Four' Performance

Each of the UK's 'Big Four', Tesco (27.9% share), Sainsbury's (15.6% share), Asda (14.4% share) and Morrisons (9.9% share) saw year on year sales decline, however Tesco performed ahead of the market, reporting a 1.8% sales decline.

With more shoppers returning to stores, online grocery sales slipped back, Kantar said.

“Digital orders accounted for 12.5% of all grocery spend, almost double the pre-pandemic proportion," commented McKevitt.

"Though online purchases are down year-on-year by 15%, it’s important to remember that this is in comparison with the strict lockdown we faced in January 2021, when the public was staying indoors when possible.”

© 2022 European Supermarket Magazine. Article by Stephen Wynne-Jones. For more Retail news, click here. Click subscribe to sign up to ESM: European Supermarket Magazine.