Private label accounted for 64% of volume sales in the six largest grocery markets across Europe – France, Germany, Italy, the Netherlands, Spain and the UK – in the 12 months to February 2024, new data from Circana has revealed.

According to Circana’s Demand Signals Category Monitor, which tracks some 175 FMCG categories and 2,000 product segments, private-label volumes are two percentage points higher than in the corresponding period last year.

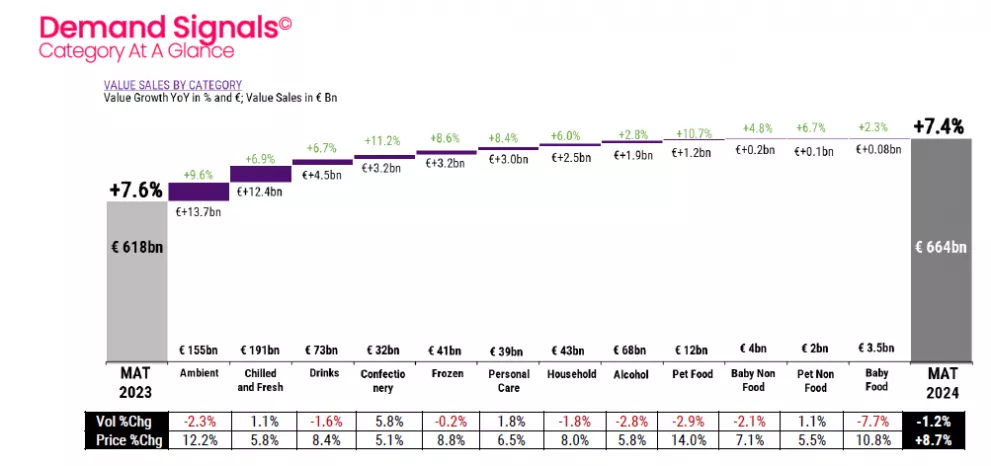

Overall, across total FMCG, volume sales declined 1.2%.

Strategies undertaken to boost volume sales include an increase in promotional intensity, Circana's data showed, with 15% more promotions compared to the corresponding period a year earlier.

This had the effect of slowing the volume sales decline as we entered the new year – in fact, for the first three months of 2024, volume sales grew marginally, by +0.7%.

Promotion Penetration

According to Circana, some 21% of FMCG products are now sold on promotion.

Private-label promotions increased by 36% in hypermarkets and 25% in supermarkets, Circana noted, while in the discounters, the volume of items sold on promotion increased by 68%.

Tackling Volume Losses

“Reflecting on the response to growing volume losses back in 2023, we can see that it was the national brands that fired the promotional starting gun all along,” commented Ananda Roy, Senior Vice President of Strategic Growth Insights EMEA, Circana.

“As a result, strategy-obsessed and consumer-focused retailers followed. However, as both manufacturers and retailers rush to shore up volumes by reducing prices and increasing promotions, the intended effect is likely to be dampened by high absolute prices, low innovation, competitive response and growing private label penetration."

Roy warned, however of the danger of "over-saturating shelves with deep deals", adding that the volume uplift gained from promotions is likely to be short-lived.

"True volume growth is unlikely to return until the end of this year, especially if it is based on more of the same," he said. "Manufacturers and retailers must look to organic growth through shopper activation, brand experience and one of marketing’s most dynamic levers, innovation.”