The latest FMCG Demand Signals report from Circana suggests that consumer demand is not likely to recover until the second half of 2024, with European shoppers continuing to buy less amid continued pressures.

FMCG value sales continue to be driven almost entirely by inflation, it found, with both retailers and manufacturers re-evaluating their strategies in order to boost demand, safeguard volume, and achieve unit growth.

Ananda Roy, Senior Vice President of Strategic Growth Insights at Circana, reports:

The recent easing of inflation has failed to spark a recovery in FMCG demand across Europe; showing just how financially distressed consumers still are, and how fundamentally the general climate of permacrisis and uncertainty has changed their shopping habits.

Now extremely price sensitive, consumers are challenging their loyalty to brands, products and even categories; with more categories becoming discretionary.

This is highlighted in Circana’s latest FMCG Demand Signals report: FMCG’s Race for Resilience: Unlocking growth. European shoppers are still buying fewer grocery and household items: unit sales are down, by 1.3% over the past year. While this is an improvement on the 1.7% decline we saw in 2022, it is no cause for celebration.

Indeed, we do not expect FMCG demand to recover until at least the second half of 2024.

Manufacturers and retailers across Europe are having to genuinely find new pricing strategies that can illuminate the best way to bolster margins and grow volumes.

A New Approach To Pricing

Pricing is still one of the levers that the most enterprising of brands and retailers can use to find new ways to drive demand. Yet the time has come to take a new approach to pricing that avoids further stripping of already thin margins.

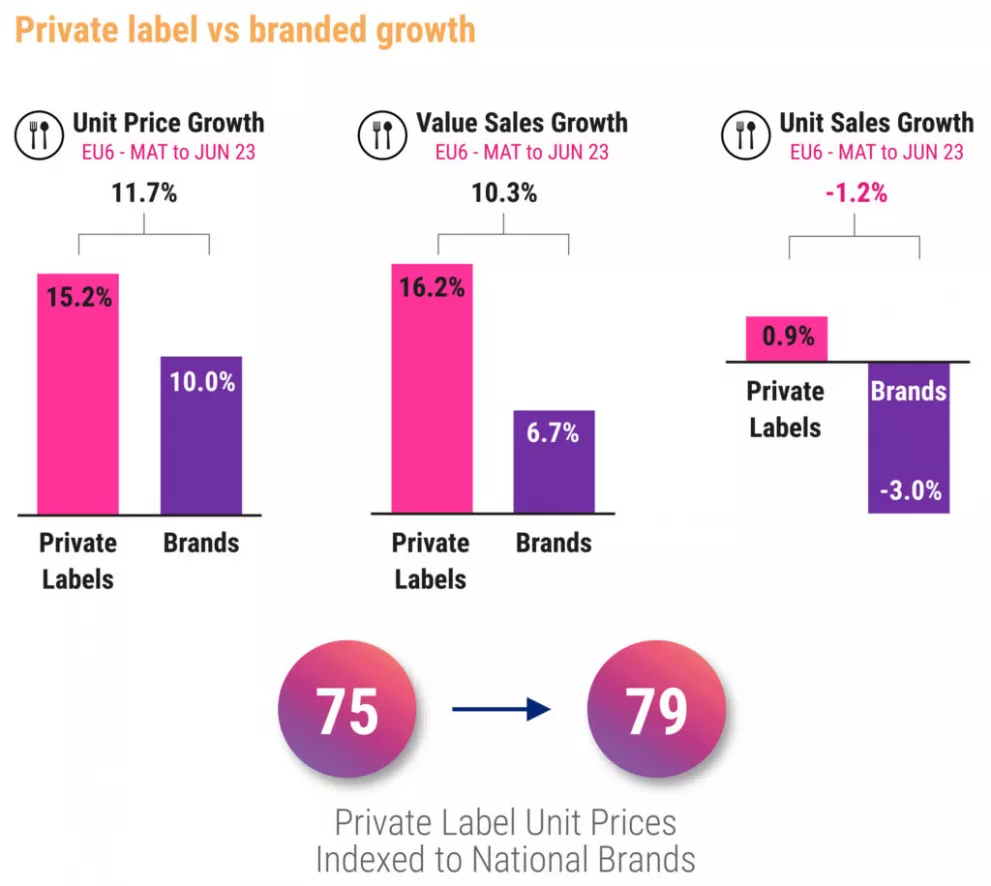

Prices have remained stubbornly high for some time, even while inflation has eased. This is now seriously undermining demand, with consumers already switching to private labels or forgoing some purchases as more categories become discretionary.

Brands have hit a price ceiling and the only way to go from here is down. Yet as intense as the pressure to cut prices is, no one wants a price war.

Elastic Fantastic Pricing

Price elasticities can impact how price changes and other variables affect volumes. While most brands are already looking at how price elasticity affects brand and category level sales, the savvier brands operating in European FMCG today are taking an even more granular approach using data analytics platforms and the very latest modelling techniques.

They are looking at how the influence of multiple variables – geography, retailer, competitor brands on shelf, customer shopping mission and even product attributes – can impact overall volume outcomes.

Flavour, for example, is one product attribute that has a surprisingly big influence on how consumers perceive a product’s value and what they consider an acceptable price.

Our pricing analytics show exotic or unusual flavours (say, cucumber) or combinations of flavours (cucumber and apple) or flavours with premium credentials (Madagascan vanilla, for example) allow brands to command a slightly higher price than competitors.

Understanding how specific product attributes affect price elasticities enables brands to be much more strategic about pricing and, ultimately, move the demand curve.

Dynamic Pricing Is Coming

Dynamic pricing is a potential solution to grocery’s inflation woes, allowing retailers to be more agile in setting prices and responding to local demand patterns.

Electronic shelf edge label technology is now widely available and affordable. Online shopping and loyalty cards have further lowered barriers to dynamic pricing, meaning it is certainly more feasible.

Even so, European grocery retailers are likely to proceed with caution. Just because the technology is available does not mean consumers like dynamic pricing or think it’s fair.

At a time when the industry faces accusations of profiteering and ‘greedflation’, retailers will want to be very sure of the reaction from consumers – and regulators – before committing to a rollout.

Promotions Can Yield Growth... But Avoid The ‘Garden Hose’ Approach

Promotions are a tried and tested tactic used to secure volume growth, but such discounting strategies have been criticised in recent years as the way to cultivate a shopper addiction to only buy when the brand is on promotion and erode brand loyalty. As a result, deals and discounts are seen as something to be avoided at all costs.

While promotions aren’t the only thing brand managers can switch on – investing in advertising and product innovation, for example – having an irresistible offer can play an important role on the path to volume recovery and should not be ignored.

Promotions can provide a short-term boost, but they don’t build long-term brand equity. Brands that rely heavily on deals to stimulate demand today will struggle to attract loyal shoppers tomorrow.

That’s not to say promotions don’t have a role to play in growing demand, but targeting and personalisation are key. The ‘garden hose’ approach to deals is fast becoming a thing of the past.

Granular Shopper Insigts

Whether it’s retailer loyalty data, first-party data or point of sale data, brands now have access to granular shopper insights on an unprecedented scale. Instead of running blanket promotions, brands should use this data to identify the consumer segments, regions and stores most likely to drive incremental volume and sales.

They must also keep a keen eye on availability. Circana consumer research shows physical availability remains crucial for shoppers, particularly when buying new products. In fact, it’s the most important purchase driver after price and promotion.

Less than 20% of shoppers will search for a product if it’s not immediately available and 23% will look for another brand or product if they can’t find what they’re looking for.

The bottom line is: shoppers don’t like seeing empty shelves. Brands with poor availability will miss out on repeat purchases and funnel shoppers to the competition – and no pricing or promotional strategy, no matter how smart, can change that.

Pricing is no longer just about looking at what competitors are doing and following that, or even going with retailer-recommended prices. Further, brands that rely heavily on deals to stimulate demand today will struggle to attract loyal shoppers tomorrow.

Instead, embrace more sophisticated pricing strategies that are now possible using analytics. Reassess current thresholds for prices, identify price elasticities and, in the process, pinpoint where growth opportunities exist.

You can read the report, FMCG Demand Signals report: FMCG’s Race for Resilience: Unlocking growth, by clicking here.