Philippe Humbert and Christoph Knoke from IRI Germany consider some of the endemic problems for category management faced by retailers and suppliers, as well as exploring a new approach pioneered with regional retailer Globus that has enabled revenue growth.

More often than not, retailers and FMCG manufacturers are not speaking the same language. They each have different ideas of what the category definition is and different KPIs that they are working towards.

While a supplier might be looking at sales on a product or product range basis, the retailer is interested not so much in the individual product but the effect that it has on basket size, frequency of trips and the total store. This means that when traditional levers such as promotions are used, each has a different perception of what success looks like.

Talking at cross-purposes and not understanding the full picture can lead to making critical decisions such as whether to list a product or run a promotion with the wrong information. Ultimately this means they are not as effective or profitable for either party as they could be.

Different Ends Of The Same Problem

Essentially retailers and suppliers are looking at different ends of the same problem, and unfortunately collaboration doesn’t happen as often as it should do because it’s hard to facilitate.

Where a retailer knows about things like shopper activation and assortment, suppliers understand marketing, product development and launches. The untapped power here is how to bring these strengths together.

At IRI, we are experts in managing and integrating data to identify actionable insights. We knew that, if we could find a partner brave enough to try something quite revolutionary, we could overcome this problem to the benefit of everyone.

The Globus Collaboration

Globus is a €3 billion regional retailer in Germany with around 47 hypermarkets across the country. It lists between 50,000 and 100,000 products in its stores, both in food and non-food.

In early 2018, IRI began working with Globus to look at how, by sharing data between them and their suppliers, it would be possible to gain a 360-degree view on the consumer’s category behaviour.

The project was a three-way process with Globus providing retailer data, integrated with its suppliers. IRI facilitated the data sharing and supplemented it with additional sources to help enable the most useful conversations.

The resulting 'Globus Supplier Cockpit; now provides data to over 200 suppliers at a very granular level, making it possible to focus on specific stores and drill down to that in an hour-by-hour timeframe. Loyalty card data has also been integrated with this, to make it possible to identify things like whether promotions drive basket size or frequency.

Promotional Proof

As an example of how the Globus Suppliers Cockpit works, let's look at a promotion that it ran on Kinder Milchschnitte.

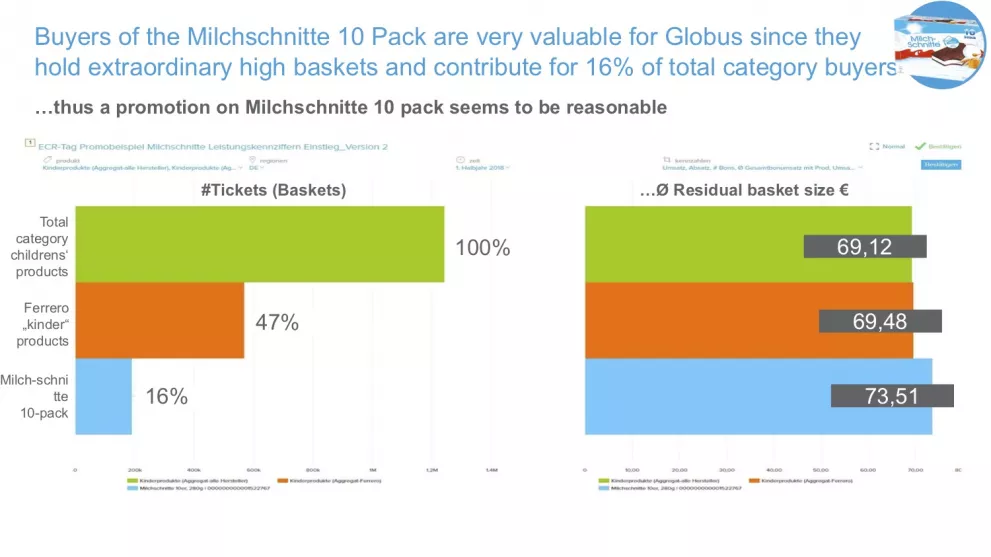

Looking at residual basket value is one way to understand what value a product can provide beyond the promotion itself. In the example below we can see that the product in question was very successful, as the standard residual basket size for buyers of the category was €69.12, whereas residual basket sizes for shoppers buying the product in question was €4 bigger.

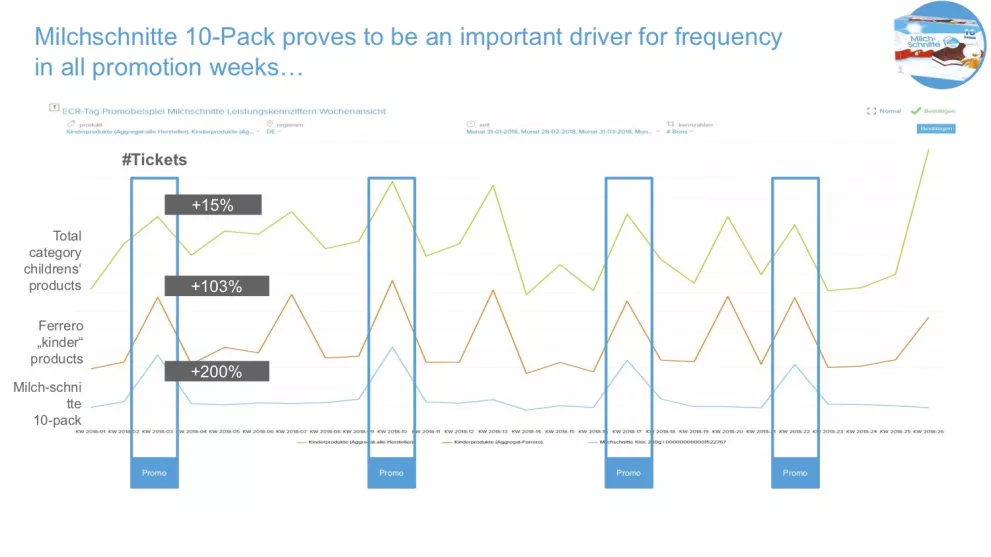

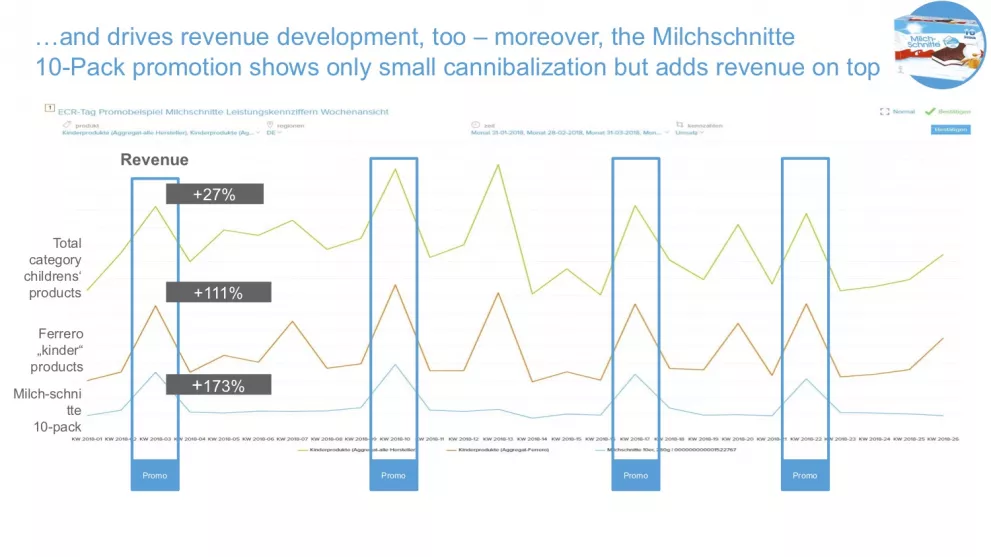

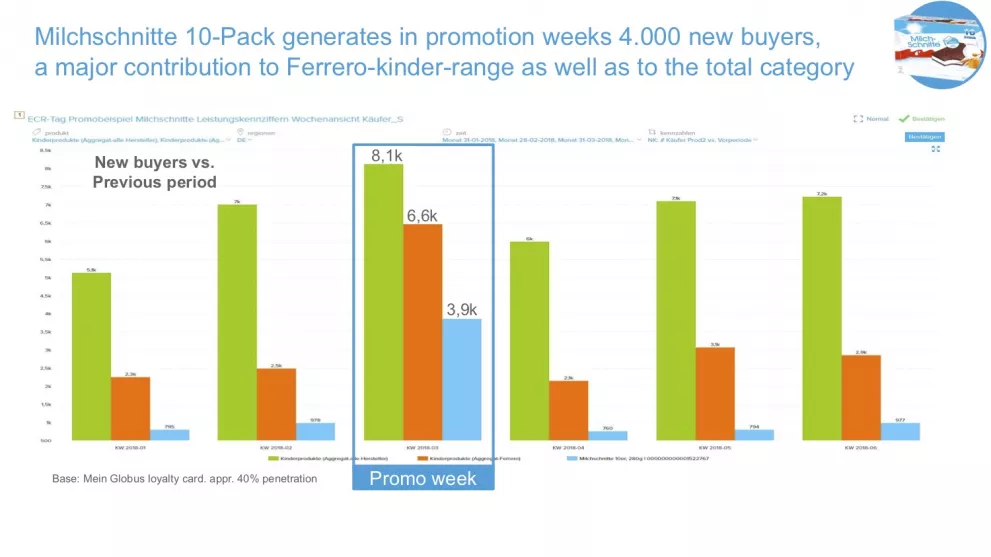

When the promotion was run on this product, we can see from the 'Globus Supplier Cockpit' data that this drove an increase in frequency of +200%, a revenue gain of 173% and attracted 4,000 new shoppers to the category during the course of the promotion.

Clearly this was a very profitable decision for both the supplier and retailer. Without the collaboration facilitated by the 'Globus Supplier Cockpit', it would have been much harder to identify this impact in such a productive way. Ultimately it helped drive revenue for both Globus and the supplier.

In five months alone during 2019, 60,000 reports were pulled by either Globus or a supplier and most of these took less than five seconds to generate.

Globus and its suppliers have really embraced this new approach to category management and as a result, the retailer’s revenues have increased by around 10% for various categories. IRI believes that, depending on the business and how well it chooses to adopt this new way of working, the revenue improvement will consistently be in the range of 3-10%.

Key to the success of this project was an open mind both from the retailer and the suppliers. This might mean having to change some thinking in terms of how you define and manage the category, but the results are worth the effort.

© 2020 European Supermarket Magazine – your source for the latest retail news. Article by Philippe Humbert and Christoph Knoke. Click subscribe to sign up to ESM: The European Supermarket Magazine.