The food and beverage (F&B) sector in the UK reported a 50.8% year-on-year increase in merger and acquisition deals in 2021, to 89 transactions, according to a new report by Oghma Partners LLP.

The 2021 annual deal value amounted to an estimated £6.6 billion (€7.9 billion) – the highest level since 2010, the report noted.

In the last four months of the year (T3 2021), the sector reported 29 transactions, with a total deal value of approximately £722.1 million (€865.3 million).

Financial Investors And Overseas Buyers

The appetite from financial investors remained strong throughout 2021, accounting for 20.7% of the total deal activity, in terms of volume, compared to 20.3% in 2020, the report revealed.

Overseas buyers accounted for 39.1% of the total deal volume, which was also the highest percentage of non-UK corporate buyers in UK F&B deals since 2010.

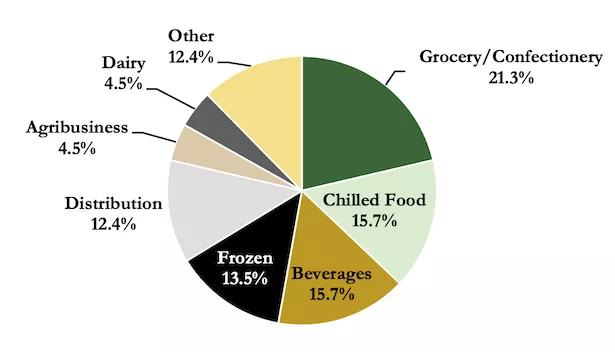

In terms of categories, grocery/confectionery saw the highest volume of deal activities in 2021, at 21.3%, followed by beverages and chilled food, both at 15.7%.

Deals with a value of over £100 million accounted for 13.5% of the total deal volume for 2021, the report showed.

Some notable deals for the year included Mondelēz’s acquisition of protein snack bar-maker Grenade, Ferrero’s acquisition of Burton’s Biscuits, and the purchase of Stock Spirits Group by Sunray Investments.

Deal Activity By Category (By Volume): 2021

Other Findings

The year 2021 was marked by a wave of activity in the plant-based food and beverage M&A space, including, among others, Portuguese retailer Sonae acquiring UK-based vegan sausage-, burger- and falafel-maker Gosh Food.

The sell-off in Oatly shares (IPO in May 2021) and Beyond Meat (IPO in May 2019), following disappointing revenue numbers last year, could impact valuations in the sector moving forward, the study noted.

The direct-to-consumer segment was also particularly active from a merger and acquisition perspective, with big food companies showing interest in expanding into this area.

Examples include Nestlé’s acquisition of SimplyCook and Barilla acquiring a majority stake in direct-to-consumer meal kit start-up Pasta Evangelists.

A significant share of higher-value deals for the year was seen in the protein space, despite the increased popularity of plant-based products.

Some notable deals in this category include Canada’s Sofina Foods acquiring Eight Fifty Food Group for £1.2 billion and Pilgrim’s Pride taking over Kerry Group’s Meats and Meals business.

Read More: Food and Beverage M&A Deals Rose By More Than A Third In 2020

'Challenging' Trading Environment

In 2022, the trading environment is expected to be more challenging, due to cost pressures arising from labour, energy, raw materials, and distribution.

The prospect of a business exit will be more testing under these conditions for weaker players.

M&A deals in the foodservice sector are expected to gain momentum this year, following the reopening of the hospitality industry, the report suggests.

Elsewhere, activity around plant-based products is likely to continue this year, as many traditional protein companies look to rebalance their portfolios and offer larger plant-based selections.