Shoppers in Ireland spent €1.2 billion on groceries in the four weeks to 29 December 2019, according to the latest data from Nielsen.

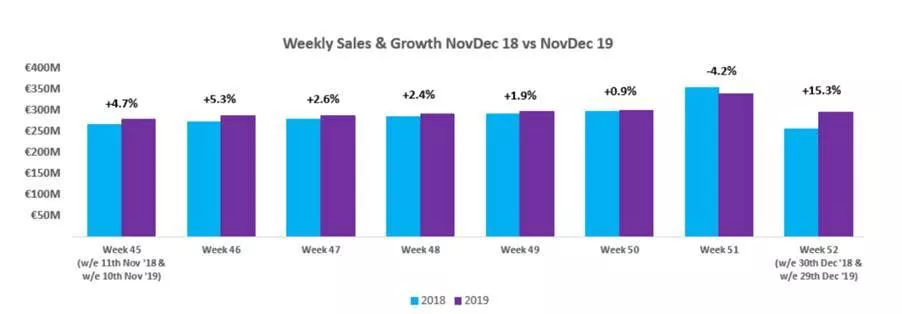

This equates to a 2.7% increase in spending, amounting to €32.5 million, compared to the same period last year.

The average grocery spend per week per household increased from €165 to €182 per week during the month, the data revealed.

In the week ending 29 December, grocery sales saw a sharp increase, rising by 15.3%, the research firm said.

Best Performing Category

Chilled groceries emerged as the best performing category, gaining €9 million in sales, an increase of 4.2% year-on-year.

Sales of frozen food and bakery products increased by 4.3% and 4.1% respectively during this period.

Pet food sales increased by 5.2%, while the confectionery segment saw 3% growth.

Ireland market leader at Nielsen, Karen Mooney, said, "The Irish market has benefited from a strong festive sales boost over the Christmas 2019 period.

"Irish consumers may have shifted spend in other areas, choosing to invest heavily in their pets this Christmas. This is a reflection on consumer trends towards pet humanisation, as we look to treat our pets more as family members and spend more on them."

Beverage Trends

Alcohol sales, a strong growth area at this time of the year, declined by 2.9% year-on-year, with sparkling wine and champagne seeing the sharpest drop, of 11.3%.

Total beer value sales declined over the four weeks, with ale (-2.6%), lager (-3.3%), cider (-4.5%) and stout (-6.8%) registering a drop in sales, data showed.

Sales of whiskey increased by 4.3%, making it the only product in the spirits category to register growth.

Sales of gin, which saw 29% growth in 2018, declined by 0.3%

However, sales of non-alcoholic and low-alcoholic beer grew by 27.2% year-on-year during the period.

"There also appears to be a shift in shopping behaviour, as Irish consumers opted to spend less on alcohol and more on low- or no-alcohol products, which could be a reflection on wellness trends," Mooney explained.

© 2020 European Supermarket Magazine – your source for the latest retail news. Article by Dayeeta Das. Click subscribe to sign up to ESM: European Supermarket Magazine.