Despite a year and a half of conflict, Ukraine's retail market has persevered, with operators adapting to the unsettling conditions and, in many cases, continuing to grow their networks.

A report issued earlier this year by GT Partners Ukraine illustrated the level to which top retailers have been able to stay the course, particularly in the food retail arena.

Between January and June of this year, out of more than 175 food retailers operating in Ukraine, 56 companies increased their store count. This is a significant increase on the same period the previous year, in which 24 companies boosted their networks. Just 16 operators reduced their number of outlets in the first half of this year.

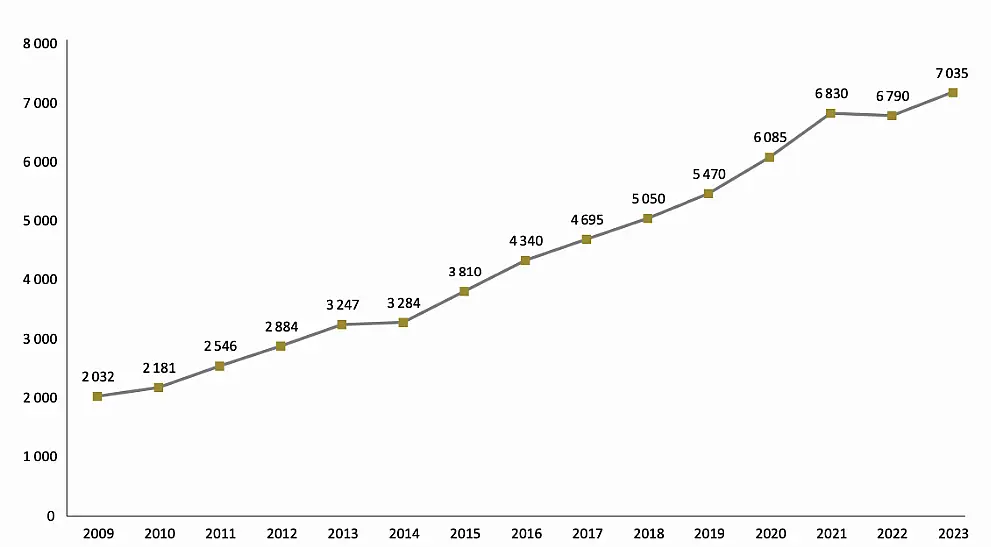

As of June 2023, the largest FMCG retailers in Ukraine – defined as those with a network of at least three stores – operated a total of 7,000 outlets across a myriad of formats (supermarkets, convenience stores, minimarkets, hypermarkets, discounters, cash and carry and delicatessens), with their combined overall store count rising 3.6%. The minimarket format accounted for the highest percentage of new store openings.

Ukraine's Top 180 Food Retailers – Store Growth (2009 to 2023)

Read More: Insights From The Front Line – Ukraine's Supermarket Sector Battles On

This number, however, does not include stores located in temporarily occupied territories, as well as outlets that are temporarily out of business due to destruction or located in the zone of hostilities, GT Partners Ukraine noted.

Let's delve into the data, as we explore the top 20 food retailers in Ukraine by store count (data correct as of June 2023).

1. ATB-market

Leading the pack is ATB-market, headquartered in Dnipro, which had a total of 1,187 outlets as of June 2023, seeing growth of 2.2% since the end of last year. The group opened ten stores in the period January to June 2023.

2. Fozzy Group

Securing the second position is Fozzy Group, based in Kyiv, which operated a total of 709 stores as of June 2023. Boasting a diverse network of banners, including Silpo (Сільпо), pictured above, Fora (Фора), Fozzy Cash&Carry, Le Silpo, Thrash!, and Favore, Fozzy Group opened 17 new stores between January and June 2023, with its store count 2.5% higher than last year.

3. VolWest Retail

Lutsk-based VolWest Retail claims the third spot, operating under the Наш Край (Nash Kray), Наш Край експрес (Nash Kray Express), and SPAR banners. Boasting 252 outlets as of June 2023, the business added seven new stores in the first half of this year, with its store count growing 1.2% year-on-year.

4. MHP

A company with a longstanding presence in agriculture and meat processing, Kyiv-based MHP operates the Myasomarket (М'ясомаркет) convenience store chain, which boasted 231 outlets as of June 2023, a 5.0% increase on last year.

5. Арітейл

Also based in Kyiv, Арітейл manages the KOLO (КОЛО) network of stores. The group boasted 228 outlets as of June 2023, having opened seven new stores since the start of the year (growth of 3.2%).

6. Lviv Cold

With a network of 200 stores, Lviv Cold (Львівхолод) operates the Rukavychka (Рукавичка) chain. The Lviv based business opened one new store in the period from January to June 2023.

7. Clever Stores

Lutsk-based Clever Stores (Клевер Сторс) takes seventh position, with a network of 194 outlets, and 28 new store openings between January and June 2023. This is an increase of 16.2%, more than any other store in the top 20.

8. Pud

Headquartered in Simferopol, Pud (ПУД) is the largest chain of grocery stores in Crimea, with a network of 163 outlets as of June 2023. It opened three stores between January and June of this year.

9. Opttorg-15/Delvi

Based in Kyiv, Opttorg-15 (ПТТОРГ-15) and Delvi (Делві) together run the Delvi network of stores, which boasts 156 outlets, and increased its store portfolio by 13 between January and June. Its store count has risen by 5.4% since last year.

10. Veresen Plus

Occupying tenth spot is Veresen Plus (Вересень плюс), located in Kropyvnytskyi, which is the largest retailer in the Kirovohrad region. The company oversees 156 stores as of June 2023, opening 17 since last year, which is an increase of 2.2%.

11. Network-Service-Lviv

Headquartered in Lviv, Network-Service-Lviv holds 11th place, as operate of the Blyzenko network of 153 stores. The group added 12 new stores between January and June 2023, seeing 8.5% growth, year-on-year.

12. Eko

Based in Kyiv, Eko operated 124 outlets as of June 2023, under the ЕКО маркет and Sympatic banners. The retailer has added no new stores this year.

13. August-Plus

Kremenchuk-based August-Plus (Август-Плюс) manages 124 outlets, and has seen 8.8% network growth since last year.

14. Tavria V/Tavria Plus

Situated in Odesa, Tavria V and Tavria Plus oversee networks such as Tavria V (Таврія В), Tavria V express (Таврія В express), Kosmos (Космос), and PURE (ПЮРЕ), operating 113 outlets, Between January and June, it opened six new outlets, with its store count growing 5.6% year-on-year.

15. Alliance Retail Group/Alliance of Entrepreneurs Osnova/Ananiev/Varshavska

Headquartered in Vinnytsia, Alliance Retail Group and affiliates operate series under banners including Home Market (Домашній маркет), OSNOVA, PRO, Bzhilka Maya (Бджілка Мая), and Grand (Гранд), managing 110 outlets as of June 2023, and growing by 4.8% year-on-year.

16. Modern-Trade/Kyivske

Odesa-based Modern-Trade (Модерн-Трейд) and Kyivske (Київське) operate a network of 102 outlets, under the Kopiyka (Копійка), Kopiyka Minimarket (Копійка-минимаркет) and Santim banners. The company opened three new stores between January and June 2023.

17. Omega

Omega (Омега), which is headquartered in Dnipro oversees the VARUS, VARUS-market, VARUS to go, and Planeta (Планета) banners, with 101 outlets in its network as of June 2023, and a growth rate of 1.0% year-on-year.

18. LK-Trans

Kyiv-based LK-Trans (ЛК-Транс) operates the LotOK (ЛотОК) network, which encompasses 96 outlets. The group opened two new stores in the period from January to June 2023, but its year-on-year growth rate fell by 1%.

19. NOVUS Ukraine

NOVUS Ukraine, which is headquartered in Kyiv, operates the NOVUS, NOVUS Express, and Mi Market banners. Its network of 95 outlets grew by 1.1% year-on-year, while opened two new stores in the first six months of the year.

20. Trade Investland/Expresstrade/Eko Tradeinvest

This consortium, including Trade Investland (Трейд Інвестленд), Expresstrade (Експрестрейд) and Eko Tradeinvest (Еко трейдінвест), operates the BOX Express Market (BOX Експрес маркет) network, which includes 84 outlets. The Kyiv-based group opened ten new stores between January and June 2023, with its network growing by 13.5% year-on-year.

Top Food Retailers in Ukraine by No. of Stores (June 2023)

| Company | Network | Central Office | N0. of outlets, June 2023 | No. of outlets, 2022 | Growth 2022 to 2023, % | |

|---|---|---|---|---|---|---|

| 1 | ATB-market | ATB, ATB express | Dnipro | 1187 | 1162 | 2.2% |

| 2 | Fozzy Group | Silpo, Fora, Fozzy Cash&Carry, Le Silpo, Thrash!, Favore | Kyiv | 709 | 692 | 2.5% |

| 3 | VolWest Retail | Nash Kray, Nash Kray Express, SPAR | Lutsk | 252 | 249 | 1.2% |

| 4 | MHP | Myasomarket | Kyiv | 231 | 220 | 5.0% |

| 5 | Арітейл | KOLO | Kyiv | 228 | 221 | 3.2% |

| 6 | Lviv Cold | Rukavychka, Pid Bokom | Lviv | 200 | 200 | 0.0% |

| 7 | Clever Stores | Sim23, Sim23 to go, Simi | Lutsk | 194 | 167 | 16.2% |

| 8 | Pud | PUD | Simferopol | 166 | 163 | 1.8% |

| 9 | Opttorg-15/Delvi | Delvi | Kyiv | 156 | 148 | 5.4% |

| 10 | Veresen Plus | Fine Market, Fine Express, Fine Discounter, VARTO, Social Shop | Kropyvnytskyi | 156 | 139 | 12.2% |

| 11 | Network-Service-Lviv | Blyzenko | Lviv | 153 | 141 | 8.5% |

| 12 | Eko | ECO market, Sympatic | Kyiv | 124 | 124 | 0.0% |

| 13 | August-Plus | MarketOPT | Kremenchuk | 124 | 114 | 8.8% |

| 14 | Tavria V/Tavria Plus | Tavria V, Tavria V express, Kosmos, PURE | Odesa | 113 | 107 | 5.6% |

| 15 | Alliance Retail Group/Alliance of Entrepreneurs Osnova/Ananiev/Varshavska | Home market, OSNOVA, PRO, Bzhilka Maya, Grand | Vinnytsia | 110 | 105 | 4.8% |

| 16 | Modern-Trade/Kyivske | Kopiyka, Kopiyka-minemarket, Santim | Odesa | 102 | 102 | 0.0% |

| 17 | Omega | VARUS, VARUS-market, VARUS to go, Planeta | Dnipro | 101 | 100 | 1.0% |

| 18 | LK-Trans | LotOK | Kyiv | 96 | 97 | -1.0% |

| 19 | NOVUS Ukraine | NOVUS, NOVUS Express, Mi market | Kyiv | 95 | 94 | 1.1% |

| 20 | Trade Investland/Expresstrade/Eko Tradeinvest | BOX Express Market | Kyiv | 84 | 74 | 13.5% |

Data sourced from GT Partners Ukraine