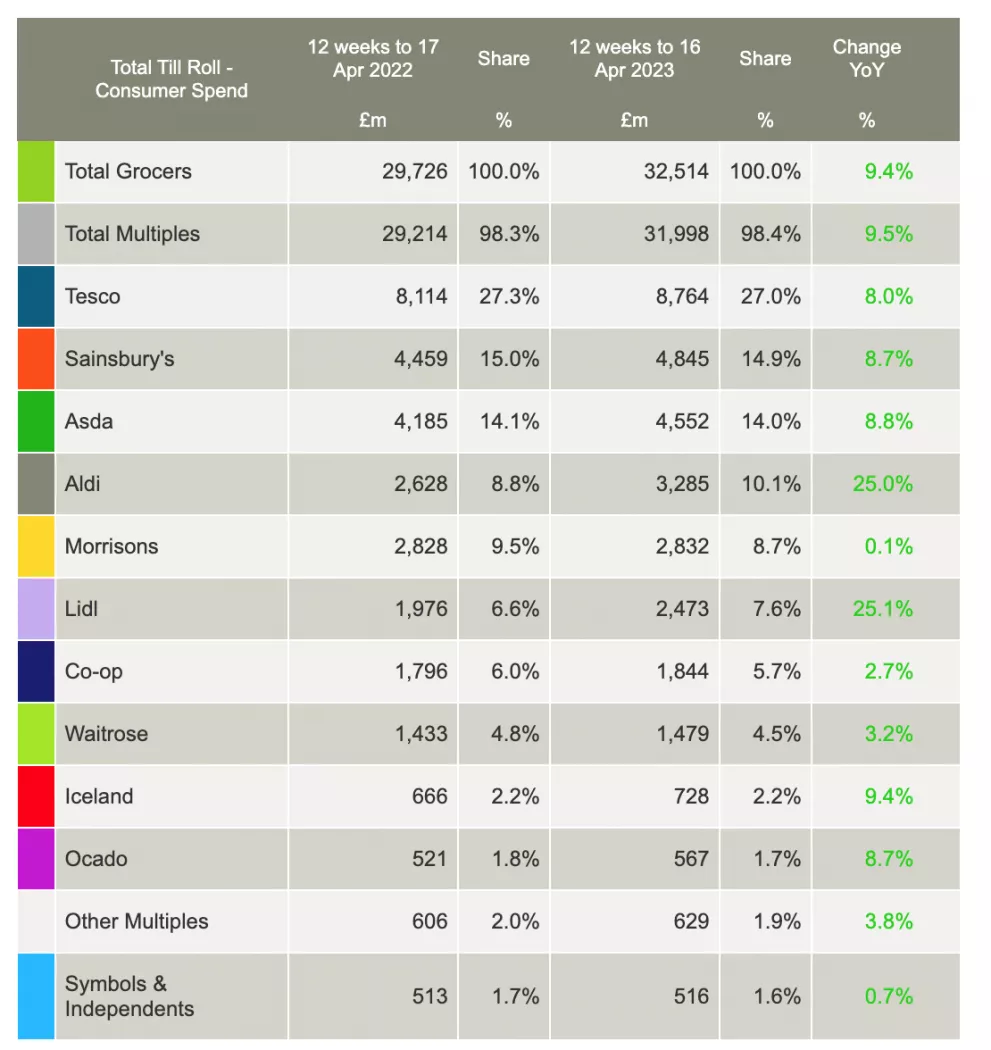

The latest market share data from Kantar for the UK market shows that Aldi and Lidl continue to outperform the competition, with Lidl reporting a 25.1% increase in sales in the 12 weeks to 16 April, and Aldi seeing sales rise 25.0%.

Aldi currently holds 10.1% market share in the UK (up from 8.8% at this stage last year), while Lidl sits on 7.6% share (up from 6.6% a year ago).

Shopping Around

“Consumers are continuing to shop around, visiting at least three major retailers every month on average," commented Fraser McKevitt, head of retail and consumer insight at Kantar. "The discounters have been big beneficiaries of this, with Aldi going past a 10% market share for the first time this month. That’s up from 5% eight years ago in 2015, so we can see just how competitive the market can be.

"Retailers are really battling it out to show value to shoppers, but if consumers feel their offer isn’t quite right then they’ll go elsewhere.”

Tesco continues to lead the UK market with a 27.0% market share (and a sales increase of 8.0% year-on-year), with Sainsbury's on 14.9% (8.7% increase in sales) and Asda on 14.0% (8.8% increase in sales).

Read More: No Changes To Copycat Private-Label Strategy, Says Aldi UK CEO

Inflation Rate Receding?

Grocery price inflation stood at 17.3% in the four weeks to 16 April, Kantar said, which is down marginally on the 17.5% recorded in the previous four weeks – however it is 'too soon' to suggest that inflation has peaked, it noted.

“The latest drop in grocery price inflation will be welcome news for shoppers but it’s too early to call the top," said McKevitt.

"We’ve been here before when the rate fell at the end of 2022, only for it to rise again over the first quarter of this year. We think grocery inflation will come down soon, but that’s because we’ll start to measure it against the high rates seen last year. It’s important to remember, of course, that falling grocery inflation doesn’t mean lower prices, it just means prices aren’t increasing as quickly.”

Private label continues to be a go-to for British shoppers looking to save money, Kantar said, with own-label lines growing at 13.5%, compared to 4.4% growth for branded lines.

Read More: The Great Tomato Shortage – One Month On: Analysis

© 2023 European Supermarket Magazine – your source for the latest Retail news. Article by Stephen Wynne-Jones. Click subscribe to sign up to ESM: European Supermarket Magazine.