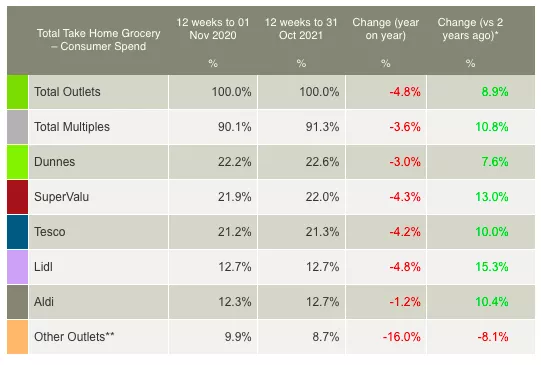

Irish grocery sales fell by 4.8% year-on-year over the latest 12 weeks to 31 October, according to the latest data from Kantar, however spend is still up 8.9% versus the same period in 2019.

According to Emer Healy, retail analyst at Kantar, the full easing of COVID-19 restrictions in October as well as “a well-timed bank holiday weekend” saw shoppers “making the most of newfound freedoms.”

Healy added, “Dining out is firmly back on the table, bringing a welcome boost to the hospitality sector as friends and families returned to bars and restaurants. With fewer meals eaten around the kitchen table, we’ve seen supermarket sales drop by 8.4% in the latest four weeks.”

Irish shoppers spent €86.1 million less on groceries in October compared with the equivalent period last year, when the nation was in lockdown.

Online Sales

Online grocery sales showed no sign of slowing down, with the category witnessing 2.2% growth in October.

Healy commented, “The data suggests that e-commerce has become a lifeline for many people as they adjust to busier routines.

“Online has won long-term converts but also continues to attract new shoppers, with online shopping novices contributing an additional €1.3 million to the sector’s overall performance.”

Other Highlights

Shoppers continued to prioritise health, as easing of restrictions translated to more mixing and socialising.

In the past month, shoppers stocked up on flu treatments and cough lozenges to ward off coughs and colds.

The sales of flu treatments and cough lozenges increased by 56% and 36%, respectively.

In the recent 12-weeks, the sale of pumpkins soared by 59%, and an extra €2 million was spent on confectionery as trick or treating was back on the agenda for Halloween.

Sales of seasonal biscuits and chocolate grew by 6.2% and 17.4%, respectively, year-on-year, while shoppers spent an extra €280,000 and €192,000 on fresh turkey and stuffing respectively.

Healy stated, “It seems everyone is looking for an excuse to celebrate and Christmas has certainly arrived in the supermarket aisles.

“With Christmas ads appearing on our screens earlier than ever, and retailers giving seasonal staples a prominent position on shelves, Irish shoppers are getting into the festive spirit.”

Top Retailers

Dunnes Stores emerged as the top retailer in the latest period with a market share of 22.6%.

A historically popular destination during the festive season, Dunnes Stores attracted a significant number of new shoppers through its doors in the latest 12 weeks, adding €24.2 million to its overall growth.

Emer Healy said, “A strong homeware offer drove this increase in footfall and empty nesters making early Christmas preparations were particularly important to Dunnes this period.”

SuperValu held a 22.0% market share as shoppers made an average of 20 trips to the grocer over the past 12 weeks – the highest among all retailers.

Tesco’s market share stood at 21.3%, helped by new shoppers as well as more frequent visits from existing customers.

Lidl’s market share remained steady at 12.7%, while Aldi boosted its market share by 0.4 percentage points to 12.7%.

Aldi announced an extensive vegan range for Christmas 2021, and the discounter proved especially popular with young families who spent an extra €200,000 in stores, Kantar added.

Read More: UK Shopping Habits 'Beginning To Settle', Says Kantar

© 2021 European Supermarket Magazine. Article by Dayeeta Das. For more Retail news, click here. Click subscribe to sign up to ESM: European Supermarket Magazine.