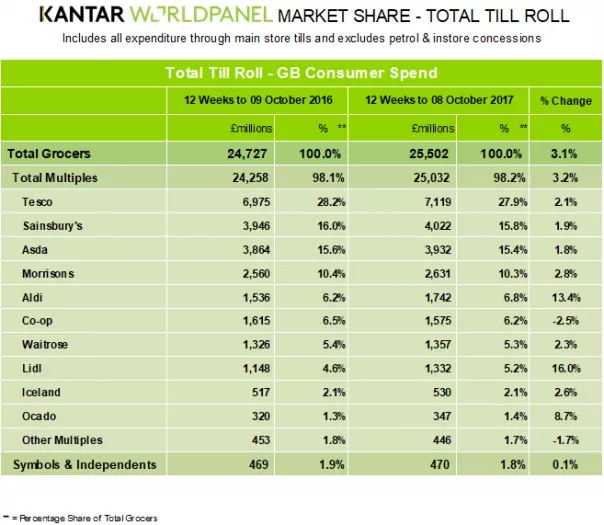

Each of the UK's Big Four supermarkets recorded a decline in market share for the 12 weeks ending 8 October 2017, according to the latest figures from Kantar Worldpanel.

Sales were up at Tesco (+2.1%), Sainsbury's (+1.9%), Asda (+1.8%) and Morrisons (+2.8%), however, all of the large retailers lost market share to smaller operators and discounters.

Overall, supermarket sales have increased in value, by 3.1%, revealing the 17th consecutive period of growth in the British grocery market.

“Morrisons was the fastest growing of the large supermarkets this period, increasing sales by 2.8%," said Fraser McKevitt, head of retail and consumer insight at Kantar Worldpanel.

"Growing sales at Morrisons’ bricks-and-mortar stores were supplemented by rapid expansion on its e-commerce platform, particularly in London and the south, where online sales have risen 29%. Despite the growth, however, the retailer’s overall market share fell by 0.1 percentage points, to 10.3%.”

Grocery Performance

After the Big Four, major gains were experienced by the discount supermarkets.

"Aldi and Lidl collectively added an additional £390 million in sales this quarter, which accounts for half of the entire market’s overall growth this period,” added McKevitt.

Lidl remains Britain's fastest-growing supermarket, with sales up by 16%, while Aldi grew by 13.4%. Both retailers increased their market share in this period, reaching 5.2% and 6.8%, respectively.

Elsewhere, Waitrose experienced a 2.3% increase in sales, but a 0.1% drop in market share, while sales at the Co-op fell by 2.5%, with a 0.3% drop in market share.

Retail Trends

In terms of the overall grocery trends, Kantar Worldpanel notes that online growth has slowed to 6.7%, from a high of 21.9% in October 2014. Online grocer Ocado saw sales increase by 8.7%.

It adds that recent stories about the poultry supply chain have not materially dented chicken sales, which remained flat in the month of September.

Meanwhile, Christmas has already started in British supermarkets, with £69 million of chocolate confectionery boxes sold in the last four weeks, while sales of mince pies reached £4 million and Christmas puddings hit £1 million.

© 2017 European Supermarket Magazine – your source for the latest retail news. Article by Sarah Harford. Click subscribe to sign up to ESM: The European Supermarket Magazine.