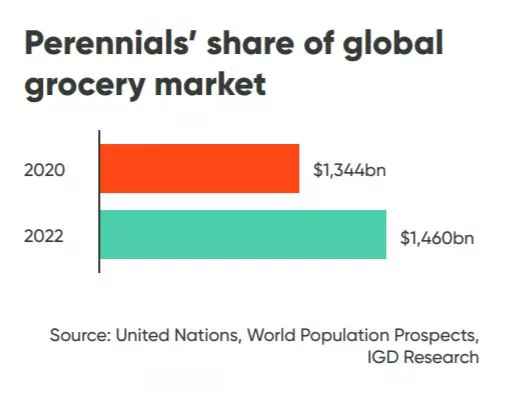

'Generation P' will drive the international grocery sector up by an incremental $116 billion (€98.2 billion) over the next couple of years, creating a $1,460 billion (€1236.4 billion) opportunity by 2022, a new study by the IGD has revealed.

The Perennial Shoppers, or Generation P, cohort comprises consumers aged 50-64 who are digitally savvy, experimental, and willing to spend more for quality.

The group accounts for 30% of all food and drink spend across the UK, Singapore, and the USA, the study noted.

The category presents a key opportunity for the international grocery retail sector as it will grow in size and significance over the next two years in these markets, according to IGD.

An ‘Often-Overlooked Group’

Director of Global Insight at IGD, Simon Wainwright, commented, “This research shows how significant Perennials are to the global grocery. They are an engaged group of shoppers who are accessible when approached in the right way.

“Competition is already fierce between retailers looking to find new ways to attract shoppers, and COVID-19 has made it hard to chart the future. Having a clear focus on your shoppers and knowing how best to reach them will be crucial to success. That’s why the time is right to focus on this often-overlooked group.”

General Characteristics

The study found that over half (56%) of Generation P shoppers shop online for food, with a third (33%) saying that they will do more in the future.

The group displayed an affinity for brands that they grew up with, as well as high regard for private label products.

Around 67% of Perennials said they bought branded goods, while 68% said they were satisfied with the quality of own-label products.

Balancing Quality With Value For Money

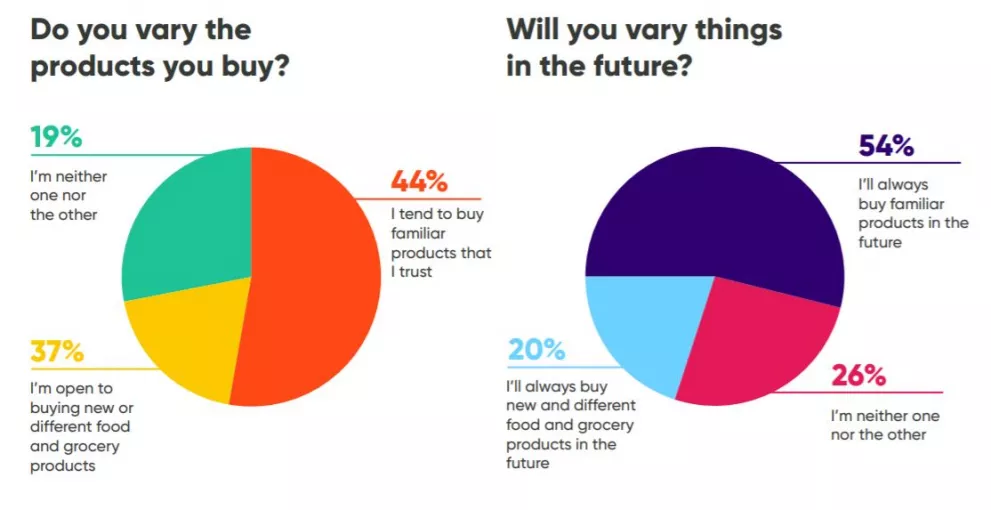

Wainwright explained, “Perennial shoppers show aspects of being habitual both in how they shop and in having an affinity for products that are familiar to them.

“However, it is clear that they also continue to evolve in terms of their tastes and choices, showing an ongoing willingness to trial new and different products as well as pragmatic considerations such as balancing quality with value for money.”

The study also revealed that the group values convenience and quality over price.

Seventy-five percent of the respondents were tempted to spend more on better quality products, while 56% spent more on products that were easier to prepare and cook.

Consumers in this group also expressed interest in products with specific ethical or environmental credentials but added that their purchasing decisions prioritised factors such as quality and price.

Regional Differences

Despite common characteristics, Generation P shoppers in the USA, the UK, and Singapore displayed clear differences arising out of social, economic, cultural, and even geographical variations.

The study found that Perennials in the UK were most likely to try new and different food and grocery products (42%) compared with Singapore (34%) and the USA (36%).

In addition, UK shoppers were most likely to cook from scratch (69%) and the least likely to buy prepared foods or eat out (15%).

In the USA and Singapore, the percentage of shoppers cooking from scratch is 63% and 58%, respectively, while those buying prepared foods stand at 23% and 25%.

The study also noted that UK shoppers prioritised specific ethical and environmental factors, checked out in-store offers and indulged in impulse buying.

Online shopping was high among Generation P shoppers in Singapore (72%) compared with their counterparts in the US (44%) and the UK (55%).

'Proven Practical Benefits'

Wainwright explained, “Perennials have embedded digital and online behaviour which they will carry forward and continue to develop into later life.

"However, this is a generation that doesn’t go digital purely for the sake of going digital – adoption of new technologies for them is driven by their proven practical benefits, and these have to outweigh those of established interactions and processes, such as traditional ‘analogue’ store-based shopping.”

In the US, Perennials regularly opt for familiar products (49%) and indulge in a big weekly shopping spree.

The study also found that they were least likely to shop for food and groceries online, with only 44% ever having shopped through the channel.

© 2020 European Supermarket Magazine – your source for the latest retail news. Article by Dayeeta Das. Click subscribe to sign up to ESM: European Supermarket Magazine.