Grocery prices in the UK 'continue to soar to near record-breaking highs', according to Kantar, which revealed that like-for-like grocery price inflation stood at 9.9% over the most recent four-week period.

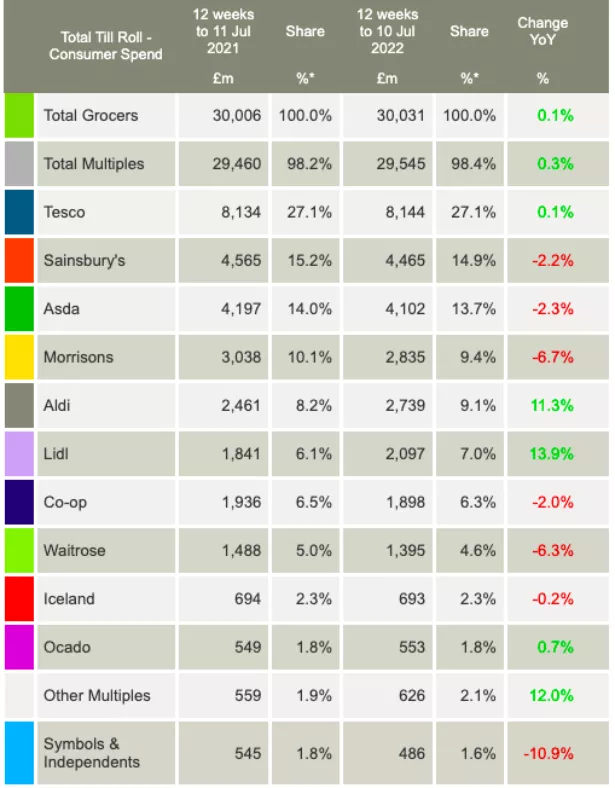

In the 12 weeks to 10 July, UK supermarket sales grew by 0.1%, the first time the market has registered growth since April 2021.

Prices have risen by 1.6 percentage points since last month, Fraser McKevitt, head of retail and consumer insight at Kantar said, describing it as the "second highest level of grocery inflation that we’ve seen since we started tracking prices in this way in 2008 and we’re likely to surpass the previous high come August.

"With grocery price inflation at almost 10%, people are now facing a £454 (€535) increase to their annual grocery bills."

Read More: UK Food Price Inflation Of 15% Is Coming, IGD Warns

Private-Label Sales Growth

Consumers are increasingly turning to own brand products as they seek to drive down the cost of their weekly shop – sales of private-label products rose by 4.1% in the 12-week period, with sales of branded items down by 2.4%.

"It’s a complex picture and the grocers are busy negotiating with their suppliers to mitigate impact at the tills as far as possible," said McKevitt. "We’ve seen this play out in the headlines in recent weeks, with some well-known brands temporarily disappearing from supermarket shelves over pricing disputes.”

Dynamic Discounters

In addition, shoppers are turning to the discounters in a bid to save money, with Aldi (+11.3% sales growth) and Lidl (+13.9% sales growth) significantly outperforming the rest of the market during the 12-week period.

Of the 'Big Four', the only retailer to see sales growth was market leader Tesco, which grew by 0.1% – Sainsbury's reported a 2.2% sales fall, Asda's sales were down 2.3%, and Morrisons reported a 6.7% sales drop.

“Over 67% of people in Britain shopped in either an Aldi or a Lidl in the past 12 weeks, with 1.4 million additional households visiting at least one of the discounters in the latest three months compared with last year," said McKevitt.

"Both retailers reached a new market share high over the past three months. Lidl now holds 7.0% of the market while Aldi climbed to a 9.1% share.”

© 2022 European Supermarket Magazine – your source for the latest retail news. Article by Stephen Wynne-Jones. Click subscribe to sign up to ESM: European Supermarket Magazine.