Walmart, working with two financial-technology startups, will allow its 1.5 million-strong US workforce to draw on their salary ahead of payday - or squirrel some of it away for a rainy day.

The world’s biggest retailer has unveiled financial-planning tools designed by Even Responsible Finance and PayActiv, a move that lets its employees access earned wages ahead of scheduled paychecks and avoid bounced checks or payday lenders.

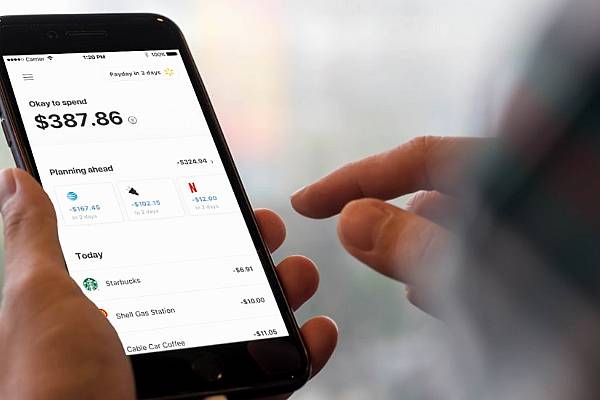

Staffers will receive eight free uses a year of the Instapay tool via Even’s personal-finance app, which is linked to the employee’s checking or prepaid account and Walmart’s payroll system.

“Traditional approaches to workforce well-being often focus solely on physical health, but we know from listening to our associates that financial well-being is just as important,” Wal-Mart chief people officer Jacqui Canney said in a statement.

The move could address a painful reality of low-income hourly workers, whose cash flow is far from predictable.

Income volatility has been increasing in recent years, according to research from the Pew Charitable Trusts, and studies from the Federal Reserve show a lack of emergency savings among many workers.

The inability to weather an unexpected car repair bill or medical expense can send a low-income worker into a debt spiral, and financially stressed workers can be less engaged and not as productive.

Largest Private Workforce

PayActiv Chief Executive Officer Safwan Shah said in an interview that he had been talking with Walmart about a collaboration for almost a year. The retailer has the largest private workforce in the US, opening up a big market.

“Every American worker faces unexpected and stressful between-paychecks expenses,” he said in the statement.

“With on-demand access to earned wages, Walmart associates will be able to save more, avoid the financial traps that reduce their take-home pay, and get a level of stability that few service sector employers provide.”

Michael Best, director of advocacy outreach for the Consumer Federation of America, said there is “cautious optimism” about financial-planning products such as the one from PayActiv.

“The only caveat is whether this creates other problems, and are there unintended consequences where workers find themselves turning to loans at the end of the month,” he said.

News by Bloomberg, edited by ESM. Click subscribe to sign up to ESM: The European Supermarket Magazine.