Irish take-home grocery sales growth more than doubled in the four weeks to 19 February 2023, as grocery inflation reached a new high of 16.4%, according to the latest data from Kantar.

Value sales increased by 10.2%, compared to 5% in January, with this growth largely driven by inflation, rather than consumption.

Shoppers bought little and often to cope with the increased cost of living as average price per pack rose 13.4% in February.

Purchase volume per trip was down 10.9%, while frequency was up 7%, the data showed.

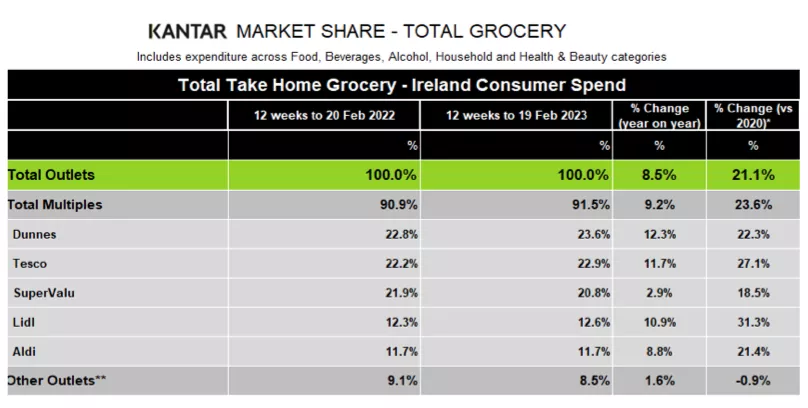

In the 12 weeks to 19 February, take-home grocery sales increased by 8.5%, with shoppers returning to store more often and contributing an additional €168.7 million to the market’s overall performance.

Shoppers spent an additional €113.56 per shopper, compared with the same period last year.

Emer Healy, senior retail analyst commented, "This time last year it was 2.4%, so [that's] a significant 14% increase within 12 months. In a year of rising costs and sky-high inflation, Irish consumers are looking for ways to manage their household budgets.

"This has led to the Irish grocery market becoming more competitive than ever, with shoppers looking for the best deals among the retailers."

Shopping Trends

Irish shoppers coped with food shortages in the fruit and vegetable aisles over recent weeks, while looking for ways to celebrate Valentine’s Day and Pancake Day this year.

“Consumers spent €2.3 million more on vegetables year-on-year, however volumes declined by 9.5%. Volumes of cucumbers and tomatoes fell significantly by 17.2% and 8.9%, respectively, year-on-year, with these two products most impacted by shortages,” Healy added.

Read More: Britain, Ireland Facing Tomato Shortage After Overseas Harvests Disrupted

Most consumers celebrated Valentine’s Day at home this year, spending an additional €1.2 million on wine, €1.5 million on chilled desserts and €3.8 million on chilled ready meals.

Moreover, an additional €326,000 was spent on gifting chocolate.

While Easter already has a notable presence in stores, Irish consumers are yet to stock up on Easter Eggs, with sales of seasonal chocolate down 29% year-on-year, Kantar noted.

The sales of flour, eggs, butter and chocolate spread increased by 11.9%, 29.6%, 19.5% and 55.5%, respectively, as shoppers indulged in pancakes to mark Shrove Tuesday.

Sales of private-label goods increased by 11.9%, compared to brands, which increased by 6.1% in the same period.

Own-label value share increased from 42.6% in 2021 to 45% in 2023, with value own-label lines reporting the strongest year-on-year growth (up 35.8%) as shoppers spent €19 million more on these ranges.

Online sales increased by 5.2% year-on-year, with shoppers spending an additional €8 million on the channel.

An influx of new shoppers boosted online sales by €7.1 million, with nearly 18% of Irish households purchasing online, data showed.

Top Retailers

Dunnes Stores emerged as Ireland's top retailer for the period, with a market share of 23.6% and 12.3% year-on-year growth.

Tesco followed in close with a market share of 22.9%, with shopper footfall for the retailer at its highest level since January 2020.

Around 80% of households visited a Tesco store at least once, with the highest increase seen in Connaught/Ulster - home to the recently acquired chain of former Joyce’s stores, data showed.

The market share of SuperValu stood at 20.8%, with growth of 2.9% - the highest level for the retailer since April 2021.

SuperValu shoppers made the most trips to stores compared to all retailers, with 20.8 trips on average, up 10.5% year-on-year.

Lidl's market share stood at 12.6%, with growth of 10.9% year on year.

An influx of new shoppers and more frequent trips contributed to an additional €21.2 million to its overall performance, Kantar added.

Aldi registered year-on-year growth of 8.8% to acquire a market share of 11.7%. More new shoppers and frequent trips contributed an additional €31.2 million to its overall performance.

© 2023 European Supermarket Magazine – your source for the latest retail news. Article by Dayeeta Das. Click subscribe to sign up to ESM: European Supermarket Magazine.